Flash Boys’ premise – and its central exposé – is really quite simple. A bunch of stock traders on Wall Street have been making tons of money with computer-aided trades that exploit and run ahead of the rest of the market. This advantage comes thanks to some special fiber optic cable that connects their computers and give them a “first look” advantage. The practice, not currently illegal, may amount to a kind of insider trading that results in a “rigged market.” The beneficiaries – principally the “high-frequency traders”at the center of the process – make millions with a milliseconds heads-up based on who is buying what, how much, and at what price. All of this, of course, is programmed into the whirring computers, as the money flows directly into the traders’ accounts, millisecond-by-millisecond. While the practice of high-frequency trading – or HFT as insiders call it – varies depending on firm and location, the traders’ super- fast computers are able to post and cancel orders at astonishing rates, even millionths of a second, and in the process, capture price discrepancies on more than 50 public and private trading exchanges that make up the American stock market. Everyone who owns equities is victimized by the practice, Lewis believes. The stock exchanges, in his view, have become “unfair places” for average investors – and that includes average investors whose pension funds and IRAs are handled by institutional investors.

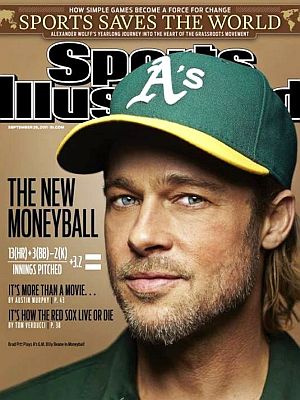

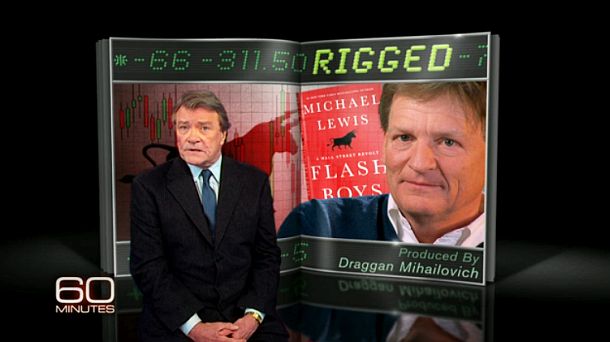

As Lewis’s book hit the streets in early April 2014, it created a bit of pandemonium, not only among the high-frequency traders, but also in the financial press and throughout the business media. Lewis and his publisher had kicked things off with an appearance by Lewis on the popular CBS-TV show, 60 Minutes, Sunday, March 30, 2014. During the interview, Steve Kroft and Lewis moved right to the heart of the issue:

March 30, 2014: Steve Kroft of “60 Minutes” is shown introducing segment on Michael Lewis &“Flash Boys.”

Kroft: What’s the headline here?

Lewis: The stock market’s rigged. The United States stock market, the most iconic market in global capitalism, is rigged.

Kroft: By whom?

Lewis: By a combination of the stock exchanges, the big Wall Street banks, and high frequency traders. . .

Lewis: …The insiders are able to move faster than you, they’re able to see your order, and play it against other orders in ways that you don’t understand. They’re able to front-run your order.

Kroft: What do you mean, front run?

Lewis: …It means they’re able to identify your desire to buy shares of Microsoft, and buy them in front of you, and sell them back to you at a higher price. It all happens in infinitesimally small periods of time. The speed advantage that the faster traders have is milliseconds; some of it is fractions of milliseconds. But it’s enough for them to identify what you’re gonna do, and do it before you do it, and do it at your expense.

Kroft: So it drives the price up.

Lewis: So it drives the price up, and in turn, you pay a higher price.

Brad Katsuyama, founder of IEX exchange, and one of the heros in Michael Lewis book, “Flash Boys.”

But Flash Boys is not only about the nefarious “flash traders” skimming off the market volume of all those individual and institutional investors who are buying and selling shares. It is also about market repair and honest “flash boys” who are trying to build a very fast but also very fair stock exchange.

These are the flash boys who have learned what’s really going on. They are the heroes in Lewis’s story; the ones causing the “Wall Street revolt” in Flash Boys’ subtitle.

Among them is a Canadian trader named Brad Katsuyama. He’s the guy who educated Lewis on the whole business of HFT skimming to begin with. Katsuyama, in Lewis’ view, is one of the few people alive who actually understands how the stock market works.

Irish telecom expert, Ronan Ryan, during “60 Minutes” explains how fiber optic connections impact stock prices.

“Of course you’re arriving there at different time intervals,” Ryan revealed to Katsuyama. And that’s when the “a ha” light bulb clicked on for Katsuyama – why the stock orders that he and other traders were trying to fill were always vanishing or bumping up in price. Ryan is also one of the “flash heroes” in Lewis’ story. To help remedy the unfairness Katsuyama founded IEX, the Investor’s Exchange, and he and his employees — now including Ronan Ryan — are the hopeful part of Lewis’s book.

Michael Lewis during March 2014 interview on “60 Minutes.”

The Today Show’s Matt Lauer interviewing Michael Lewis about his book, “Flash Boys,” April 1, 2014. |

Brad Katsuyama and William O’Brien trade verbal jabs during a CNBC show debating HFT and “Flash Boys,” April 1st, 2014. |

Following the 60 Minutes story on March 30, 2014, the web and blogosphere lit up with Michael Lewis and Flash Boys stories. Lewis was quickly booked on other TV talk shows. He did interviews on The Today Show, The Charlie Rose Show, The PBS Newshour, Daily Show with Jon Stewart, and others. He also appeared on business talk shows including CNBC and Bloomberg Television.

On the April 1st, 2014 CNBC show, Power Lunch – a live business and stock market news show – the conversation became quite heated as CNBC’s Sue Herera and Bob Pisani interviewed Brad Katsuyama and William O’Brien, president of BATS Global Markets.

On the show, Katsuyama and Lewis were criticized by O’Brien for their assertions that the market was unfair to ordinary investors: “Shame on both of you for falsely accusing literally thousands of people and possibly scaring millions of investors in an effort to promote a business model,” meaning Katsuyama’s IEX exchange. O’Brien also pressed Katsuyama on his claims in Lewis’ book that the market was rigged.

“I believe the markets are rigged,” Katsuyama said in response to O’Brien, “and I also think you’re part of the rigging.” Lewis later joined the CNBC debate and more accusations flew from both sides, as a shouting match ensued over the book’s indictment of HFT. CNBC later reported that the 20-minute debate had stopped activity on the floor of the New York Stock Exchange as traders watched the debate. The “twitterverse” also fired up with reaction to the show.

Michael Lewis with Jon Stewart during his April 2014 appearance on the Daily Show to discuss “Flash Boys.”

The New York Times Magazine of April 5th, 2014 ran a Michael Lewis excerpt from “Flash Boys” and put Brad Katsuyama on the cover.

Within a few days of Flash Boys’ release, the Washington Post and the New York Times were reporting that the Justice Department, the Securities and Exchange Commission, and the Commodity Futures Trading Commission were either launching new investigations or had existing probes underway. The FBI, for one, announced it would investigate HFT for possible frontrunning, market manipulation, and insider trading.

So, with his latest book, Lewis succeeded in bringing fresh attention to stock market technology and a major new issue. As Lev Grossman put it in a short review of Flash Boys for Time magazine. “More than ever, the economic injustices of the world are made possible by the unequal distribution of information. Lewis is doing his part to smooth out those differences.”

But there’s more to Michael Lewis than his recent excursion into the HFT fray. Turns out he’s something of a literary “flash boy” – meant in the best sense of that term – here referring to his copious output as a business and financial writer over the last 25 years or so. During that time Lewis has become one of the nation’s most engaging interpreters of “business culture” in its many forms, facets, impacts, and personalities.

Michael Lewis with some of his best-selling books. Photo, Mark Costantini/Chronicle.

Michael Lewis was born in New Orleans, Louisiana in October 1960. His father was a lawyer and his mother a community activist – also a descendant of James Monroe. On his father’s side there is reported “Lewis & Clark” lineage. His grandfather was the first Supreme Court justice in Louisiana. Young Michael attended Isidore Newman prep school in New Orleans, graduated from Princeton in Art History in 1982, worked briefly with New York art dealer Daniel Wildenstein, and then went to the London School of Economics where in 1985 he received an MA in Economics.

At age 24, he went to work at Salomon Brothers, first in New York for training and then to London as a bond salesman. At Salomon he was also schooled in derivatives. But while he was at Salomon in London, he also began testing his writing wings by offering anonymous perspectives from the trading floor. These pieces were published in The Spectator and the Sunday Telegraph, and when Lewis saw traders passing around photocopies of his pieces, he knew this might be something he could do. A few years later, in 1988, he left Salomon to begin a writing career focusing on financial issues. In 1989 he published Liar’s Poker, a book about Wall Street in the go-go 1980s that became a best seller, sending Lewis into the business/financial literary world in a big way.

Since then he has published 14 more books on a range of topics, from Silicon Valley and presidential politics, to baseball, football, and fatherhood. Yet in most of these books there is typically a thread of technology and/or business running through the storyline. In addition to the books, he has also written extensively for newspapers and magazines. He is currently, as of April 2014, a columnist for Bloomberg News and a contributing writer for Vanity Fair. A 2012 piece he did for Vanity Fair on President Obama, gave Lewis direct access to the President – including playing in one of Obama’s pick-up basketball games (photos below in Sources). His articles have also appeared in The New York Times Magazine, The New Yorker, The New Republic, Slate, Sports Illustrated, Foreign Affairs, and Poetry Magazine. He has served as editor and columnist for the British weekly The Spectator. But it has been his best-selling books that have established him as a talented writer with something to say.

Lewis’s first breakthrough book was Liar’s Poker, an era-defining work on Wall Street greed. The book is part autobiography and part no-holds-barred exposé. In it, Lewis describes his own experiences as a Salomon Brothers’ bond salesman during the 1980s, where he made millions for the firm during those go-go years. Lewis’s account offers a behind-the-scenes look at what was then going on. Says publisher W.W. Norton – “from the frat-boy camaraderie of the forty-first-floor trading room to the killer instinct that made ambitious young men gamble everything on a high-stakes game of bluffing and deception.” The book’s name is taken from liar’s poker, a high-stakes gambling game popular with the bond traders in the book.The Sunday Times of London wrote in one review: “If you thought Gordon Gekko of the Wall Street movie was an implausibly corrupt piece of fiction, see how you like the real thing. This rip-the-lid-off account of the bond-dealing brouhaha is the work of a real-life bond salesman… Read all about it: headlong greed, inarticulate obscenity, Animal House horse-play…”

Published in 1989, Liar’s Poker became one of the books that captured Wall Street during that particular “wild west” era of the 1980s when big deals and big money flowed unencumbered by government regulators. Along with Barbarians at the Gate by Bryan Burrough and John Helyar and The Bonfire of the Vanities by Tom Wolfe, Liar’s Poker became one of “must reads” for understanding Wall Street culture in the 1980s.

The late 1980s were a time when Japan was cleaning America’s clock economically; an ascendant global power whose automobile and electronics industries had phenomenal growth. Lewis’s Pacific Rift – a 1990 book on U.S.-Japanese business and cultural differences – arrived just as U.S.-Japanese relations became the topic of the day.First published by Whittle Direct Books in Knoxville, Tennessee, the book used the subtitle, “Adventures in the Fault Zone Between the U.S. and Japan.” W.W. Norton, the house that would become Lewis’s main publisher, later did the book with a new cover and subtitle shown at left.

In Pacific Rift, Lewis follows and features two businessmen – an American in Japan and a Japanese in America – to explore each other’s culture to point up why Americans and Japanese don’t understand each other. “Lewis’s take is often comic, but his message is serious,” wrote William J. Holstein of Business Week in one review. “He sees Japan as it is and sums up the challenge: ‘How can our capitalism beat their capitalism?’ By keeping his eyes open and asking the right questions, this newcomer [Lewis] comes up with penetrating insights.” Publisher’s Weekly also said of the book, “There is more tough sinew here than in a stack of more weightier tomes.” Japan’s bubble eventually burst, but Lewis at the time had his hand on the economic pulse of the moment.

In October 1991, Lewis published The Money Culture, a collection of his essays and magazine pieces that returned to his favorite Wall Street haunts and the excesses of the 1980s. His stories featured the various business-related personalities and predicaments of that time – Donald Trump, Michael Milken, T. Boone Pickens, the RJR Nabisco takeover, Louis Rukeyser, the Savings & Loan crisis, the Japanese, and other topics.“There is not much in the way of true revelation here,” observed one reviewer from Library Journal, “but with Lewis’s puckish humor and inimitable writing style, the stories are entertaining and thought-provoking. …[H]e proves that ‘the raw itch for money is still with us as surely as ever . . . and the money on Wall Street is better than elsewhere’.”

One Amazon.com reviewer found the book “consistently funny, insightful, and a good primer on several financial issues that dominated the 1980’s…” Another suggested that chapters such as “Leveraged Rip-Off” and “How Wall Street Took the S&Ls for a Ride” ought to be required reading for undergraduate business majors. Some believe The Money Culture is one of Lewis’s most underrated and least appreciated titles. It was reissued with new cover art in January 2011.

In 1996, Lewis took leave of Wall Street and finance for a time and focused instead on politics and the presidential election cycle. His book, titled Trail Fever and published by Knopf in May 1997, chronicled the world of presidential candidates, campaign workers (“rented strangers”), spin doctors, and more, focusing primarily on the Republican Party. Lewis came to the campaign a political neophyte, and that worked to his advantage in making fresh observations – many hilarious, but quite on point.The full parade of Republican candidates is covered, among them: Pat Buchanan, Phil Gramm, Lamar Alexander, Steve Forbes, and Alan Keyes. John McCain is also covered as is Green Party candidate Ralph Nader. Principal contestants Bob Dole and Bill Clinton are included as well, but don’t get the ink the others do. Dole is seen “as a man who set out to prove he would never be president” and Clinton described by some as “the big snow goose.”

Once Lewis discovers that the major candidates all practice risk avoidance in their public speeches and really don’t have much to say, he turns more of his attention to the minority candidates. Chief among these is the least known candidate of all, successful businessman Morry Taylor, CEO of Titan International, a tire and wheel manufacturer. Nicknamed “the Grizz” for his bear-like gruffness, Taylor ran in all the primaries but gathered about 1 percent of the vote. Still, Lewis found that Taylor and the other minority candidates often had more to say.

The paperback edition of “Trail Fever” was renamed “Losers” and given new cover art. Click for copy.

When the book came out in paperback, Lewis renamed it Losers, and publisher W.W. Norton added new cover art, as shown at right. Norton’s synopsis on the back cover of that edition notes in part:

“…As he follows the men who aspire to the Oval Office, Lewis discovered an absurd mix of bravery and backpedalling, heroic possibility and mealy-mouthed sound bytes, and a process so ridiculous and unsavory that it leaves him wondering if everyone involved – from the journalists to the candidates to the people who voted – isn’t ultimately a loser… Losers is a wickedly funny, unflinching look at how America really goes about choosing a president.”

“It isn’t anything like traditional political journalism,” notes another reviewer. Yet Lewis’s well-turned prose make the story lively and engaging. The book also serves as something of an American time capsule for 1996.

After his excursion into presidential politics, Lewis turned next to the world of Silicon Valley and high-tech entrepreneurs.

In October 1999, he published The New New Thing: A Silicon Valley Story – capturing a bit of the tech mania before the bubble burst. In this book, Lewis tells his story through Jim Clark, founder of three billion-dollar high-tech companies – Silicon Graphics, Netscape, Healtheon.One reviewer at Wired magazine noted: “Michael Lewis takes readers inside the now-familiar world of Silicon Valley excess, the frantic deal making, the absurdly hyped expectations, the phenomenal wealth….”

In the book, Lewis gives readers the inside story of the battle between Netscape and Microsoft, and also shows Clark trying to persuade some investment bankers on the worth of Healtheon.

As he goes about his story-telling, Lewis maps out the changing future of business and markets, showing how the new high-tech guys are forcing a reassessment of traditional Wall Street business models.

In the book, Jim Clark is also revealed to be the creator of Hyperion, the world’s largest single-mast sailboat, a machine more complex than a 747. Clark claims he will be able to sail it via computer from his desk in San Francisco, perhaps the basis of another new company.

Continuing in the high-tech vein, Lewis published Next: The Future Just Happened, in July 2001, a book about the then emerging power of the internet. A year earlier, the stock market had its high-tech meltdown, with internet stocks in particular taking a major drubbing, leading some to believe the internet was just another passing technology.

Lewis’s book, however, helped dispel that notion, by serving up some examples of the internet’s “power-toppling” abilities. Lewis profiles three teenagers empowered by the net: Jonathan Lebed, a 15-year-old New Jersey high school student who made headlines when he netted $800,000 as a day trader; Markus Arnold, the 15-year-old son of immigrants from Belize who became a top-ranked legal expert on AskMe.com dispensing lawyer-level advice; and Daniel Sheldon, a 14-year-old Brit who helped propel the music file-sharing movement.These stories helped Lewis present his book’s main point: that established power centers and professions – be they lawyers, the stock market, or the music industry —are no longer the presumptive ruling kings or set centers of business. Power and prestige are up for grabs in the new world of the internet; the technology is revolutionary, and is changing the way people live and work. Lewis argues this rapidly evolving technology will upend the power structure of society; no entrenched interest or established profession is safe. The amateur and/or individual can be king. The old maxim “information is power” is given new meaning and new reach, as the internet is wielded by new participants. In his internet travels, Lewis also finds that internet democratization typically leads to some form of commercialization, and so should be embraced by business, which at the time was skeptical of the technology. Business Week noted: “His book is a wake-up call at a time when many believe the net was a flash in the pan.” A BBC television spin-off was produced by way of this book, titled “The Future Just Happened,” which was hosted and narrated by Lewis.

In 2003, came the best-selling book, “Moneyball: The Art of Winning an Unfair Game.” Click for copy.

“[E]verything you know about baseball is wrong. Sacrifice bunts? Waste of an out. Stolen bases? Not worth the risk of making an out. Pitching? Overrated. Fielding? Overrated. What’s underrated, according to Lewis and his central figure, Oakland A’s General Manager Billy Beane, is ‘the ability to control the strike zone.’ This means, in short, swing only at pitches one can hit well…”

In Moneyball, Lewis focuses on how Billy Beane uses sabermetrics to build a winning team and business. Using the new approach, Beane’s Athletics improve their baseball performance and also bring new undervalued players to the team. The A’s couldn’t afford to sign high school standouts or free agents seeking big paydays, so they went after college players and overlooked has-beens that had hidden statistical value.‘Moneyball’ soon became shorthand for data-driven innovation in any field. In fact, using this approach, the 2002 Oakland Athletics, with a lowly $41 million payroll for player salaries, became competitive with larger market teams such as the New York Yankees, who spent over $125 million in payroll that same season. Beane’s new statistical approach ends up taking the A’s to the playoffs in 2002 and 2003. According to New York Magazine: “The book, which sold over a million copies, changed the way baseball was played, made ‘Moneyball’ a shorthand term for data-driven innovation in any field, and turned Beane himself into a savant legend well outside of baseball circles.” The book would also help propel Lewis to a new level of celebrity as a hit Hollywood film would be produced based on the book starring Brad Pitt as Billy Beane. Yet the film had some screenplay and production snags and would not appear until 2011. More on the film and Lewis’s books in Hollywood a bit later.

Coincidentally, another baseball book from Lewis came out in 2005 – a short book about his high school baseball coach, Billy Fitzgerald, coach “Fitz.” The book – titled, Coach: Lessons on the Game of Life – grew out of a March 2004 New York Times Magazine piece Lewis had published when he learned that some parents wanted to throw out his old coach for his tough-love manner. Other alumni were leading an effort to remodel the old school gym and have it named after Fitz. So Lewis waded in with an ode to his old coach based on his own experiences playing baseball for him as a teenager when Lewis attended Isidore Newman prep school in New Orleans. Lewis at the time, wasn’t exactly a model student-athlete, describing himself as “racking up C-minuses, picking fights with teachers, and thinking up new ways to waste my time.” But Coach Fitz, who had been critical and demanding of the young Lewis, turned to him at a crucial moment. Lewis, one of the team’s pitchers, was called upon for a key game, given the ball by Coach Fitz, thereby conveying great confidence in Lewis’s ability. Lewis rose to the occasion in the game and the confidence he won as a result soon spread to his classroom work and beyond. But Coach Fitz could also be intimidating at times, leveling harsh critiques and stinging judgements, which is why some parents wanted to show him the door. But as Lewis would write on behalf of his coach, Fitz did not sugarcoat; he taught perseverance and how to fight through adversity. His message wasn’t simply about winning, but rather, lessons on how self-respect is earned by hard knocks, discipline, failures and successes. These were lessons that served Lewis well, and by raising them in his story, he believed they might work for others as well.

September 2006: First edition hardback of “The Blind Side” by Michael Lewis, W.W. Norton, NY. Click for copy.

As the story is told by Lewis, and described by publisher W.W. Norton: “…Michael Oher is one of thirteen children by a mother addicted to crack; he does not know his real name, his father, his birthday, or how to read or write. He takes up football, and school, after a rich, white, Evangelical family plucks him from the streets….” The book follows Micheal Oher through his years at Briarcrest Christian School, his adoption by Sean and Leigh Anne Tuohy, and on to his position as one of the most highly sought prospects in college football. The book’s title “blind side” has multiple meanings – but refers to a specific term of art in football” – the left tackle position protects the “blind side” of a right-handed quarterback who typically does not see defenders coming at him from that left side, and thus is “blind-sided” when tackled or sacked from that direction. Yet “blind side” in this story can also refer to racial blindness of the Touhys or the “blindness” of society in not seeing its homeless people.

Sean Touhy, Michael Oher & Leigh Anne Touhy at University of Mississippi football game.

In the meantime, Lewis published three more books, The Real Price of Everything: Rediscovering the Six Classics of Economics in January 2008; Home Game: An Accidental Guide to Fatherhood in May 2009; and Panic: The Story of Modern Financial Insanity, November 2009. In Real Price, Lewis gathered together the classic economic works of Adam Smith, Thomas Malthus, David Ricardo, Thorstein Veblen and John Maynard Keynes – along with his own editorial commentary on these works. The book serves as a weighty reference (1,472 pages) for any student of economics who may want to understand the market forces and government policies that have shaped the modern world. Home Game, adapted from a series of essays Lewis wrote for Slate magazine, attempts to capture the triumphs, failures, humor, frustration and exhilaration of being a new father during the first year of each of his three children’s lives. “It’s an engaging journal that selectively details how Dad grew up as well….,” said Kirkus Reviews. “His failings amuse . . . and he captures serious moments with a warmth that shows he’s a pretty good dad after all,”wrote the Los Angeles Times. And Panic is about the most important and severe upheavals in past financial history, which Lewis wrote, in an effort “to recreate the more recent financial panics, in an attempt to show how financial markets now operate.”

More Books

March 2010: “The Big Short” by Michael Lewis focused on Wall Street’s 2008 financial collapse. Click for book.

With the repercussions of the market crash then still reverberating throughout the U.S. and the global economy, The Big Short made a well-timed arrival. It was published in March 2010 and spent six weeks at No. 1 on The New York Times nonfiction bestsellers list, remaining on that list for 28 weeks. According to Nielsen BookScan data, during one week in March 2010, Lewis sold 60,000 hardcover copies of The Big Short, followed by 40,000 more then next week.

Michael Lewis set out to tell the story of Wall Street’s collapse from a somewhat different perspective. He would not use the “usual suspects” — i.e., the big banks, investment house CEOs, or federal regulators. Rather, Lewis chose maverick individuals who saw what was coming. These were folks who stood apart from the herd, and by Lewis’s count, there were damn few of them at the time who really understood what was happening. They were the ones who, in some cases, made tons of money on the “smart guys’” failure to understand their own financial wizardry. They saw that the bubble was about to burst, and some of them made enormous sums of money by “shorting” the sub-prime mortgage market in 2005-2008 – i.e., anticipating its drop in value. Everybody else, meanwhile, watched their portfolios evaporate.

Michael Burry, one of the mavericks featured in “The Big Short” who found calamity hidden away in sub-prime mortgage bundles – and opportunity.

Lewis also features Dr. Michael Burry in The Big Short. Burry, a thirty-something ex-neurologist suffering from blindness in one eye and Asperger’s syndrome, was also a diligent investor who burrowed into the details of the sub-prime mortgage market. Burry had formerly made a name for himself while a neurology resident at Stanford University posting investment insight and stock picks online during the dot-com stock market boom. His astoundingly accurate picks drew the attention of some well-known investors who invested in him, later spawning his hedge fund, Scion Capital, which made tens of millions for Burry and his investors betting on the sub-prime mortgage collapse.

Steve Croft of “60 Minutes” spent two days with Michael Lewis at his Berkeley, CA home for “The Big Short” story.

“If you had to pick someone to write the autopsy report on the Wall Street financial collapse 18 months ago,” Kroft explained in the introduction, “you couldn’t do any better than Michael Lewis. He is one of the country’s preeminent non-fiction writers with a knack for turning complicated, mind numbing material into fascinating yarns.

“His new book, called The Big Short…, comes out later this week and it explains how some of Wall Street’s finest minds managed to destroy $1.75 trillion of wealth in the subprime mortgage markets.” Kroft would spend two days with Lewis at his home in Berkeley, California to do the piece for 60 Minutes.

During the 60 Minutes segment, Kroft and Lewis wander about Lewis’s hillside compound in Berkeley, California which consists of a main house and three cottages as the interview takes place. At one point Lewis is asked which book produced the money to buy the home. He replies, “This would’ve been The New, New Thing, that bought this place,” referring to his earlier book on Silicon Valley entrepreneurs.Lewis estimates he has sold “some millions” of books. “I don’t know how many millions. Not John Grisham millions, but millions.” Also in the segment, Lewis estimates as of that time he had sold “some millions” of books. “I don’t know how many millions. Not John Grisham millions,” he told Kroft, “but millions.”

The Big Short received lots of attention beyond 60 Minutes, and the book was generally well received by critics. Two writers touting the book at The Oxonian Review noted: “Michael Lewis has managed to tell the story of the subprime collapse by combining history, finance, and biography into what is surely one of this year’s most entertaining books.” Graydon Carter of Vanity Fair added: “It is the work of our greatest financial journalist, at the top of his game..” And Andrew Leonard of Salon.com also praised The Big Short: “Superb: Michael Lewis doing what he does best, illuminating the idiocy, madness and greed of modern finance. . . . Lewis achieves what I previously imagined impossible: He makes subprime sexy all over again.” The Big Short received the Los Angeles Times Book Award and it also received the Robert F. Kennedy Center for Justice and Human Rights 2011 Book Award, given annually to a novelist who “most faithfully and forcefully reflects Robert Kennedy’s purposes…” And as noted earlier, The Big Short was optioned for possible film production by Brad Pitt even before its publication.

“Boomerang,” a Michael Lewis book on economic troubles in Europe, was published in October 2011. Click for book.

“Michael Lewis possesses the rare storyteller’s ability to make virtually any subject both lucid and compelling. . . . Combining his easy familiarity with finance and the talents of a travel writer, Mr. Lewis sets off in these pages to give the reader a guided tour through some of the disparate places hard hit by the fiscal tsunami of 2008, like Greece, Iceland and Ireland, tracing how very different people for very different reasons gorged on the cheap credit available in the prelude to that disaster….”

The essays in Boomerang did not endear Lewis to European leaders trying to convince the world of their solvency. “Iceland won’t let him go back,” said his old friend, Sean Tuohy, and in Greece, he was persona non grata as well.

Flash Boys’ Fire

Meanwhile, Lewis’ latest book, Flash Boys, will likely continue to stir the pot for a time, moving both politicians and populist sentiment. Observed one Forbes writer, James Poulos in a late March 2014 piece titled “Michael Lewis Is About To Disrupt The Politics Of High Speed Trading”:

…Not only is Lewis about to hit a nerve with America’s most powerful financiers — he’s poised to strike a painful, divisive chord with everyday Americans. High-speed trading epitomizes a whole sequence of contemporary fears about an economy that’s out of control for all but an elite few of players, and sometimes for them, too.

Once we worried that robots would take over planet Earth; now, we’re worried that our algorithms will slip our grasp, whirling away with no master at all…

Flash Boys, meanwhile sold 130,000 copies in the U.S, in its first week of publication. That’s more that twice the rate of The Big Short. And in early April 2014, Sony Pictures was reportedly near a deal on purchasing the film rights for Flash Boys with Scott Rudin and Eli Bush producing. Sony had also produced Moneyball.

|

“The Lewis Effect” Two of the “stars” in Michael Lewis’s latest book, Flash Boys, are Ronan Ryan and Brad Katsuyama, noted earlier at the top of this story. In January 2013, before the book idea was hatched, they received a dinner invitation from Michael Lewis. At the time, Lewis was working on a story about a former Goldman Sachs trader who was convicted of stealing computer code and he wanted to talk with Ryan and Katsuyama to get their take on what was happening. Ryan and Katsuyama by then had set up their own trading start-up company, the IEX Group, and were only a few months into the effort. Here’s some of an April 2014 exchange that occurred between Ryan and New York Magazine reporter Kevin Roose on the meeting with Lewis and subsequent events.  Ronan Ryan of the IEX Group. We were probably 15 people at that time, we’d just raised our first round of funding. And, you know, market structure is not that… interesting to laymen. But as a start-up, if Michael Lewis wants to write about you, I’m guessing 100 out of 100 would say yes to that. So it wasn’t a real discussion. Q: How much time did he spend with you and Brad? At the time, we didn’t know we were opening ourselves up to a book. We’d been profiled in the Wall Street Journal, and we really thought this was going to be an article in Vanity Fair. A book is the holy grail!… Q: Did he give you any warnings? Like, By the way, this is going to be crazy? It’s been nuts. We’re getting a lot of positive calls.  IEX Guys: Rob Park, Brad Katsuyama, Ronan Ryan, and John Schwall. Q: Who’s been calling? People who want to invest in IEX? Friends from back home? Q: What’s the most memorable call you’ve gotten so far today? It’s funny, you have all this excitement with the television, your wives are telling you you’re so great, and your parents are proud of you, and you come here at 6:30 in the morning and some guy from Kentucky…dialed a phone, and left a voice message saying something like that. You’re like, ‘Holy shit, you’re really touching Americans!’ There were chills. We played it over the speaker. I was really amazed. Source: Kevin Roose, “What It’s Like to Star in a Michael Lewis Book,” New York Magazine, April 1, 2014. |

Most of the action on Wall Street these days is not with the floor traders, but with the fiber optic cable feeding super-fast computers.

Other stories at this website dealing with Wall Street and/or investing, include: “Wall Street’s Gekko” and “Celebrity Buffett.” Other business-related and business history stories include, for example: “Disney Dollars”, “Empire Newhouse”, “Ted Turner & CNN”, “All Sports, All The Time”, “Murdoch’s NY Deals”, and “Basketball Dollars.” See also the Madison Avenue category page for additional stories on business, advertising, and culture. Thanks for visiting – and if you like what you find here, please make a donation to help support the research and writing at this website. Thank you. – Jack Doyle

|

Please Support Thank You |

____________________________________

Date Posted: 19 April 2014

Last Update: 2 June 2022

Comments to: jackdoyle47@gmail.com

Twitter: https://twitter.com/PopHistoryDig

Article Citation:

Jack Doyle, “Flash Boy Lewis: 1989-2014”

PopHistoryDig.com, April 19, 2014.

____________________________________

Sources, Links & Additional Information

June 2009: Michael Lewis and Tabitha Soren on “Today Show,” in segment about Lewis’s book, “Home Game.” |

June 2012: Michael Lewis at Princeton commencement where he urged graduates to never forget how lucky they are and how they might proceed because of that. |

In 2012, Michael Lewis spent time with President Barack Obama in writing about him for “Vanity Fair.” White House photo, Pete Souza. |

Michael Lewis joined President Obama in one of his basketball games as part of the “Vanity Fair” story he wrote. White House photo, Pete Souza. |

January 2014 Kindle e-book edition of “Making It Happen” by Leigh Anne Tuohy. Rosetta Books. |

Sam Polk, “For the Love of Money,” New York Times, January 18, 2014.

James Poulos, “Michael Lewis Is About To Disrupt The Politics Of High Speed Trading,” Forbes, March 29, 2014.

Steve Kroft, reporter; Draggan Mihailovich, producer, “Is the U.S. Stock Market Rigged? A New Book from Michael Lewis Reveals How Some High-Speed Traders Work the Stock Market to Their Advantage,” 60 Minutes/ CBS.com, March 30, 2014.

Nick Baker and Sam Mamudi, “High-Speed Traders Rip Investors Off, Michael Lewis Says,” Bloomberg News, March 31, 2014.

“Author Michael Lewis: US Stock Market Is Rigged,” MoneyNews.com, Monday, March 31, 2014.

Michael J. De La Merced and William Alden, “Scrutiny for Wall Street’s Warp Speed,”Deal Book, New York Times, March 31, 2014.

Andrew Ross Sorkin, “Fault Runs Deep in Ultrafast Trading,” New York Times, March 31, 2014.

“Michael Lewis Discusses His Latest Book: ‘Flash Boys: A Wall Street Revolt’,” Charlie Rose Show, March 31, 2014.

“Katsuyama vs. O’Brien – Who Won The fight?,” CNBC.com, Tuesday, April 1, 2014.

Eric Levenson, Dashiell Bennett, “Is High-Frequency Trading as Bad as Michael Lewis Wants You to Think?,” TheWire.com, April 1, 2014.

“On A ‘Rigged’ Wall Street, Milliseconds Make All The Difference,” NPR/Fresh Air, April 1, 2014.

Kevin Roose, “What It’s Like to Star in a Michael Lewis Book,” New York Magazine, April 1, 2014.

Felix Gillette, “The Fame-Ready Cast of the Michael Lewis Publicity Blitz,” Business Week.com, April 2, 2014.

Diane Brady, “Lewis Calls Flash Boys Blowback ‘Thoughtless’,” BusinessWeek.com, April 2, 2014.

C. Thompson, “Lewis-Katsuyama-O’Brien Rumble Just the Beginning: Opening Line,” Bloomberg.com, April 2, 2014.

“Watch Michael Lewis Explain ‘Flash Boys’ with Jon Stewart on ‘The Daily Show’,” WSJ.com, April 2, 2014.

Rachel Nolan, “Behind the Cover Story: Michael Lewis on Complexity and the Rigging of Wall Street,” New York Times, April 3, 2014.

‘Flash Boys’ Investigates How High-frequency Traders Anticipate Wall Street’s Next Move Faster,”(Michael Lewis Interview w/ Judy Woodruff), The PBS NewsHour, April 4, 2014.

Derek Wallbank, “Lawmakers Spurred by Lewis Book Try to Slow Flash Traders,” Bloomberg.com, April 4, 2014.

Book-TV, “Author Michael Lewis Takes Viewers’ Questions on His New Book “Flash Boys: A Wall Street Revolt,” C-Span.org, April 5, 2014.

Michael Lewis, “The Wolf Hunters of Wall Street: How a Band of Outsiders Discovered That the Stock Market Was Rigged — And Set Out to Change it,” New York Times Magazine, Sunday, April 6, 2014.

Felix Salmon, “The Lewis Effect: Michael Lewis’ New Best-Seller Focuses the Public’s Attention on High-Frequency Trading. What Will Change as a Result?,” Slate.com, April 7, 2014.

Felix Salmon, “Michael Lewis’s High-speed Journalism,” Reuters.com, April 7, 2014.

“iBooks Bestsellers: Lewis Unseats Roth,” PublishersWeekly.com, April 8, 2014.

Dave McNary, “Sony Nearing Movie Deal on Michael Lewis’ ‘Flash Boys’,” Variety.com, April 8, 2014.

Steven Pearlstein, “‘Flash Boys’: Michael Lewis Does it Again,” Washington Post, Sunday, April 13, 2014, p. G-1.

Carrie Hojnicki, “The Amazing Life And Career Of Wall Street’s Favourite Writer, Michael Lewis” Business Insider (Austrailia), April 15, 2014.

Emma Brockes, “Michael Lewis: ‘Wall Street Has Gone Insane’,” The Guardian, April 16, 2014.

“Barack Obama to Michael Lewis on a Presidential Loss of Freedom: ‘You Don’t Get Used to It — At Least, I Don’t’,” VanityFair .com, September 5, 2012.

Jacob Goldstein, “Putting a Speed Limit on the Stock Market,” New York Times, October 8, 2013.

Michael Lewis, “Obama’s Way,” Vanity Fair, October 2012.

Scott Ross, “Brad Pitt Keeps Making Michael Lewis Richer and Richer,” NBCBayArea.com, May 30, 2012

Jessica Pressler, “It’s Good to Be Michael Lewis: He Could Have Made a Fortune in Business. Instead, He Made a Fortune Writing About It. Plus—a Fortune for Everyone He Writes About,” New York Magazine, October 2, 2011.

Susanna Kim, “10 Economic Lessons From Michael Lewis’ Boomerang,” ABC News, September 28, 2011.

Andy Lewis, Gregg Kilday, “ ‘Moneyball’ Author Michael Lewis on Oscar Hopes, Working With Brad Pitt and His New ‘Liar’s Poker’ Screenplay (Q&A),” The Hollywood Reporter, September 27, 2011.

Andy Lewis, Matthew Belloni, “‘Moneyball’ Author Michael Lewis to Script ‘Liar’s Poker’ for Warner Bros.,” The Hollywood Reporter, September 26, 2011

Christopher Rosen, “Author Michael Lewis on ‘Moneyball,’ His Critics, and What Hollywood Can Learn From Sabermetrics,” Moviefone.com, September 22, 2011.

Joel Krupa and Braden MacDonald, “Shorting our Future”(Review of the Big Short), The Oxonian Review (Oxford, England), Issue 14.1 / Politics & Society / October 18, 2010.

Claude Brodesser-Akner, “Brad Pitt Moving Quickly on Adapting Michael Lewis’s The Big Short,” Vulture.com, June 24, 2010.

Michael Lewis, Author, “The Big Short: Inside the Doomsday Machine,” Q&A/C-Span, April 4, 2010.

Frances Dinkelspiel, “Michael Lewis: I Don’t Make $$ When My Books Become Movies,” BerkeleySide.com, March 17, 2010.

Steve Croft, Reporter, “Author Michael Lewis On Wall St’s Delusion: Author Tells “60 Minutes” What Led to Wall Street Collapse and Who Predicted It,” 60 Minutes/CBS, March 12, 2010.

Michael Lewis, Website.

“About IEX,” IEXtrading.com.

“Michael Lewis,” Wikipedia.org.

“Brad Katsuyama,” Wikipedia.org.

Author Page, Michael Lewis, WWNorton .com.

Michael Lewis, “The End,” BizJournals.com, November 11, 2008.

David Kipen, “Billy Beane’s Brand-New Ball Game / How the A’s General Manager Played His Cards Right to Turn His Team Around,” (Book Review of Moneyball), SFgate.com, Sunday, June 1, 2003.

“Moneyball (film),” Wikipedia.org.

“Bill James,” Wikipedia.org.

Neil Genzlinger, “Television Review: In Pursuit of Reality and Life in the Internet Age,” New York Times, August 6, 2001.

Book Review, “Next: The Future Just Happened, Michael Lewis, Author,” Publisher’s Weekly, July 30, 2001.

Gene Lyons, “Book Review: The Money Culture (1991), Michael Lewis,” Entertain-ment Weekly, October 25, 1991.

“Princeton Baccalaureate 2012: Michael Lewis,” YouTube.com, posted by Princeton University.

______________________________