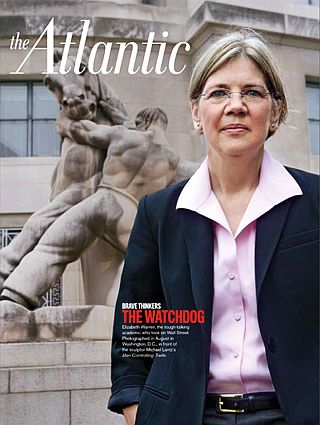

Elizabeth Warren featured in an Atlantic magazine story as she rose in Washington policy circles, here photographed in front of the D.C. sculpture, “Man Controlling Trade.”

But at the core of Elizabeth Warren’s soul and career, and her populist politics, is what she knows about the elite economic structure that governs America – and in particular, how banks, laws, and markets fuel and protect that structure at the expense of the 99 percent.

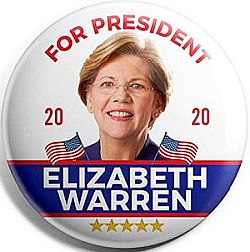

Warren has worked at the intersection of law and economics for more than 40 years, and during her bid for the Democratic presidential nomination in 2020, and as a U.S. Senator, she has pursued and advocated policy changes that would help democratize the economy for all Americans.

Contrary to her detractors, Warren’s remedy isn’t a dismantling of market economics. She is a “free market girl,” as she once put it, believing that markets can do a lot of good. Yet absent guardrails, as she has also explained, markets can be oppressive, arrogant, stupid, and unfairly beneficial. In her bid to level the playing field, she is part Mother Jones and part FDR; an economic insurgent intent on making structural change. Her plans are aimed at a fairer distribution of national gain and opportunity so that the 99 percent have a better shot at a decent life. That, of course, is exactly why the Wall Street elite, most of corporate America, and their handmaidens in Washington have opposed her efforts at financial reform, fairer taxation, and consumer protection. They fear what she might accomplish in these and related areas. Indeed, CEOs and government officials who have been eviscerated by her probing will grudgingly attest to her abilities in political and legal combat (see her YouTube “greatest hits,” for example).

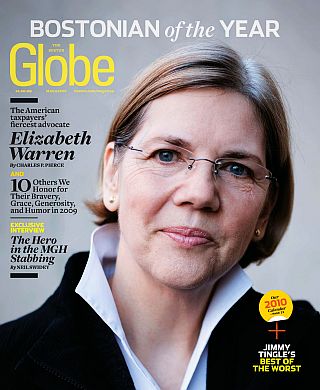

December 2009. Elizabeth Warren, during her ascent, on the Boston Globe Sunday magazine cover as “Bostonian of the Year,” with tagline, “The American taxpayer’s fiercest advocate.”

In The Cauldron

It was the nation’s economic meltdown of 2008-2009 – and in particular, Wall Street’s bad boy bankers and credit manipulators – that really brought Elizabeth Warren front and center. For years she had dug deep into the machinations of banking, finance and commercial law, which made her an especially useful advisor as Wall Street crumbled and Washington panicked.

In mid-November 2008, while hosting a barbecue at her home for some of her law students, she received a phone call from Senate Majority Leader Harry Reid (D-NV) asking her to serve on the Congressional Oversight Panel (COP) for the $700 billion Troubled Assets Relief Program (TARP) – the Congressional “Hail Mary,” as some have called it, to save the economy.

Before long Warren was in the thick of overseeing how the money was being spent, asking tough questions, ruffling egos, and becoming something of a people’s champion. In the process, she added a progressive ingredient of her own: a whole new federal agency — the Consumer Financial Protection Bureau, to protect consumers from financial fraud and credit traps.

Along the way, Warren became a special advisor to the President, and later, to the Secretary of the Treasury. After that, in 2012, she became the first women to be elected U.S. Senator from Massachusetts, reelected in 2018, and then candidate for President in 2020. But all of this was a long way from her roots in Oklahoma, where the early seeds of economic fair play were planted in her ambition. Becoming a politician, however, was not part of her plan – at least initially.

1966. Elizabeth Warren, Oklahoma high school debate champion with debate partner, Karl Johnson.

She was born Elizabeth Ann Herring in June 1949 — the last of four children and some years younger than her three older brothers. Growing up in Norman, Oklahoma – on “the ragged edge of the middle class” as she would later describe it – gave her some early, first-hand “hard times” economic lessons. At age 12, her father, a former fencing and carpet salesman, had a heart attack, plunging the family into difficult straits. He later became a janitor. Her mother went to work at Sears to help pay the bills, and they barely kept their home. The family station wagon, however, was repossessed. These experiences became part of Elizabeth Warren’s internal resume`.

But young “Betsy,” as she was called in childhood, was a pretty smart kid back there in Norman, where she completed grade school. At age 16, she graduated high school, heading up Oklahoma City’s Northwest Classen High School’s debate team, which took the state championship. Her family couldn’t afford college, but her debating skills brought a scholarship to George Washington University in Washington D.C. However, she dropped out after two years, deciding to marry her high school boyfriend, James Warren in November 1968. He was a mathematician and an engineer with NASA whom she’d been dating since she was 13. They settled in Houston, where Jim took a job with IBM. There, Elizabeth began commuting to the University of Houston to complete her degree. In 1970 she received a B.S. in speech pathology and audiology.

Jim’s work then took them to New Jersey, where he worked on the country’s antiballistic missile program. Elizabeth then briefly taught public school children with disabilities, before becoming pregnant. In 1971, her first child, Amelia, was born. Elizabeth was then 22.

After Amelia turned two, Warren enrolled in Rutgers University Law School at Newark. She received her J.D. there in 1976 and passed the bar as well. But shortly before graduating, Warren became pregnant with her second child, Alexander, and decided to practice law from home and briefly did wills and other legal work. During 1977-1978 she became a law lecturer at Rutgers School of Law. Husband Jim, however, was not keen on Warren’s pursuit of a career outside the home. The couple divorced in late 1978, but she kept the Warren surname.

1971. Elizabeth Warren with newborn Amelia. |

Early 1970s, Warren with young daughter, Amelia. |

By this time, the Warrens had moved back to Houston after Jim’s career had taken a new turn. Elizabeth then became an assistant, and later, associate professor at the University of Houston Law Center. A new bankruptcy law had come into effect about that time, and Warren used it in her classes. But she was also curious about this law beyond teaching, e.g., if this law was the fix, she wondered, what was the problem? Bankruptcy, it would turn out, and its parade of players – from hard luck citizens to giant corporations and the banks themselves – would become a central focus for much of her career.

Conservative Liz

1979: Young conservative, age 30.

Warren would write several articles in the 1978-1980 period, on utility regulation, for example, promoting a pro-industry position. A 1980 article in the Notre Dame Law Review, argued that public utilities were over-regulated and that automatic utility rate increases should be instituted. She championed free markets over government regulation, and believed people should have the right to make as much money as possible.

Warren’s conservatism might have helped her land the UT job. According to Russell Berman reporting in 2020 for the The Atlantic, Russell Weintraub, then a law professor at UT Austin, recruited Warren after seeing her teach. Weintraub reportedly told colleagues at the time: “she was the smartest person in Houston, and we should hire her if we could.” UT also wanted Warren’s budding law-and-economics specialty on its faculty, and according to Calvin Johnson, a UT law professor, neighbor and commuting buddy of Warren’s, they hired her because she wrote well “with supply-and-demand curves from a conservative point of view.”

Still, Warren was mostly into policy at the time, not politics; she was essentially non-political. A sometimes independent, she bounced around between Republican and Democrats in national elections. She voted for the Republican Gerald Ford in 1976, but backed President Jimmy Carter in his unsuccessful reelection bid in 1980. Warren was a registered Republican from 1991 to 1996, because she thought “those were the people who best supported markets.” She finally left the Republican Party when she found it was no longer “principled in its conservative approach to economics and to markets,” and instead, tilted the playing field in favor of large financial institutions. (However, it wouldn’t be until her later years in Washington, post-1995, when Warren got to see Democrats and Republicans up close in the policy making process).

In July 1980, Warren married for a second time, to law professor Bruce H. Mann, a legal historian. She had met Mann at an earlier law and economics gathering. By 1981, she and Mann both had teaching posts at the University of Texas (UT) in Austin, although Mann’s was a visiting slot. He taught at Washington University in St. Louis and shuttled back and forth to Austin. Warren, meanwhile, agreed to teach bankruptcy law at UT. In the classroom, she earned a reputation for lively lectures and Socratic probing.

1986. Warren at the University of Texas; faculty photo published in the 1986 edition of law school yearbook.

Warren’s curiosity about bankruptcy, meanwhile, soon evolved into a major research project in which she would team up with two other UT professors — law professor Jay Westbrook and sociologist Teresa Sullivan — to examine what was happening in the nation’s bankruptcy courts. But the initial idea for the project began with Warren.

Bankruptcy Project

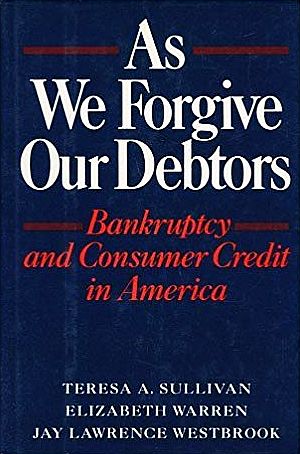

“I get this clever idea,” she would later tell the Boston Globe, recounting her plan. “I’m going to expose these sleazy debtors who are exploiting the bankruptcy system and their poor, hapless creditors and enriching themselves as far as the law allows by going through bankruptcy court. I go out with these other two folks [ UT colleagues Westbrook and Sullivan] and we start collecting data about the families who are filing for bankruptcy. We end up doing this big study, and it ends up as a book [As We Forgive Our Debtors: Bankruptcy and Consumer Credit in America, November 1989]. And it completely turns me around…”

The debtors, in fact, were more victims of circumstance – not deadbeats or cheats, as Warren and others had first assumed. “We learned that nearly 90 percent were declaring bankruptcy for one of three reasons: a job loss, a medical problem, or a family breakup,” Warren would later write.

Nov 16, 1989, “As We Forgive Our Debtors: Bankruptcy and Consumer Credit in America,” 1st Edition, Oxford University Press, 370pp. Click for copy.

Bankruptcies were going up in America in the 1980s, and continued doing so through the 1990s. Over a million families each year were filing for bankruptcy. People had problems in their lives before, but bankruptcy filings had stayed far lower. What had changed in the 1980s and 1990s? What difference was there in America? The answer: incomes stayed flat awhile core expenses went up, and people quit saving. Some went deeper and deeper into debt, as credit card companies, payday lenders, and subprime mortgages outfits saw new opportunities and pounced. And with that, the seeds of more and continuing bankruptcies were planted, figuring in part, in the later economic meltdown.

The bankruptcy project changed Warren, especially since the research required looking into people’s personal lives. “She saw more of the very difficult side of life of the people who go through the bankruptcy process,” said former colleague and co-author Westbrook. “She saw their struggles. And she saw a variety of ways in which the credit industry manipulates things in order to get them ever deeper into debt.” For Warren, bankruptcy and consumer credit would become lifelong issues – and emblematic of the systemic structural powers she would later name as part of the “rigged” economy that favors the one percent.

Upward Bound

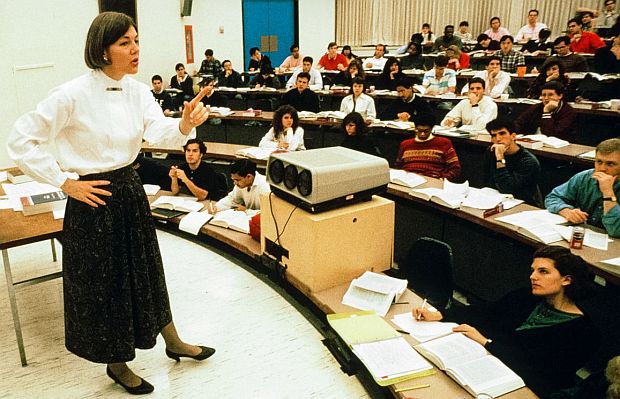

By 1987, meanwhile, Warren’s law career began moving toward the Ivy League, a she joined the University of Pennsylvania Law School that year as a full professor (along with her husband). By 1990, she had an endowed chair at Penn, becoming the William A. Schnader Professor of Commercial Law. She would teach contract and bankruptcy law at Penn Law from 1987 to 1995. Former students of Warren’s at Penn remember her as a tough but likable professor. Shannon Sanfilippo, a 1993 Penn Law graduate, noted, “I think she had all of our names memorized on the first day, so there was no place to hide.” Penn Law graduate, Eric Marandett noted: “She processes things very quickly, and she also understands arguments much more quickly than most.” Another remembered her as “whip-smart.”

By 1992, as a visiting professor, Warren taught commercial law for a year at Harvard Law School as a visiting professor. Then, in 1995, Warren left Penn to become Leo Gottlieb Professor of Law at Harvard Law School.

1990s. Professor Elizabeth Warren lecturing law school students at the University of Pennsylvania.

1995 was the year Warren began edging into politics, though haltingly at the time – receiving a call to come to Washington. “I didn’t come from a political family,” she said. “I hadn’t been political as an adult. I was raising a family, teaching school and doing my research,” she said.

Congress Calls, Pt. 1

In 1995, former Oklahoma Congressman Mike Synar (D), an old high school debating opponent of Warren’s (“defeated me three years in a row back in high school,” Synar would say), asked her to help him run a special commission reviewing the bankruptcy system – the National Bankruptcy Review Commission. Synar was appointed by President Bill Clinton to head the blue-ribbon panel that had the difficult task of recommending changes to national bankruptcy laws at the time when the banking industry was pushing hard to cut protections—even as the number of Americans declaring bankruptcy was skyrocketing. The finance industry wanted to make it harder to expunge debt on the theory that too many Americans were gaming the system.

1997. Inside title page for National Bankruptcy Review Commission final report, Vol .1, October 20, 1997.

Synar, however, died prematurely at age 45 when he was stricken by brain tumor. Warren then had to fend for herself, which she ably did, then leading the Commission and preparing its recommendations and report to Congress in 1997.

In the process, Warren was getting a new political education. “I quickly discovered that every single Republican was on the side of the banks and half the Democrats were,” she said. “But whenever there was someone who would stand up for those working families, it was a Democrat.”

For Warren, the experience was a turning point: “I picked sides, got in the fight, and I’ve been in the fight ever since.” Over the next several years she would be active in opposing legislation that would restrict consumers’ right to file for bankruptcy, later butting heads with Senator Joe Biden, who then sided with the banks on reform legislation, not consumers.

Warren continued teaching and writing at Harvard Law School. In March 2000, another book on bankruptcy, The Fragile Middle Class: Americans in Debt was published. This book, co-authored with Warren’s earlier UT colleagues, Teresa Sullivan and Jay Westbrook, examined why most families in bankruptcy would be considered to be middle class and that most of them ended up in dire financial straits due to medical problems, job loss, or the breakup of the family. It picked up from their first book, with more data.

In September 2003, Warren and her daughter, Amelia Warren Tyagi, published The Two-Income Trap: Why Middle-Class Mothers and Fathers Are Going Broke. At that time, a fully employed worker earned less inflation-adjusted income than a fully employed worker 30 years earlier. Families were then spending less on clothing, appliances, and other forms of consumption, but the costs of core expenses such as mortgages, health care, transportation, and child care had increased dramatically. The result was “the two income trap” – that even families with two income earners were no longer able to save and were piling up ever greater debt. Both incomes were committed largely to necessities, and when an unforeseen event occurred – serious illness, job loss or divorce – families had no reserve or discretionary income to fall back on. Two-income families were then worse off than single-income families of the golden, post-war 1950s-1960s era, having less financial security and less disposable income. Among the Warrens’ suggested remedies and actions were prohibiting credit card companies from charging grossly unfair interest rates and exposing banks that were luring minority customers with “loan-to-own” high mortgage rates certain to default. They also pointed out that families then seeking to live in neighborhoods with better schools for the sake of their kids’ education, were buying homes they could not afford. In any case, The Two-Income Trap received positive reviews. Time magazine called it “a startling account of the elusiveness of the American dream.” And Warren herself would later describe the books as “what happened to the middle class over a generation. From the 1970s to the early 2000s, there was a hollowing out of the middle class.”

Politico magazine’s “Friday Cover” featuring a 2018 story about Warren and the Dr. Phil show in 2004-05.

Dr. Phil

The Two Income Trap, or at least part of it, also got the attention of daytime TV host, Phil McGraw of the popular Dr. Phil Show, where the good doctor – in front of a live studio audience and millions of TV viewers – dispensed healing advice on any number of fronts to America’s middle class.

In Chapter 7 of The Two Income Trap, there was an ending section titled, “The Financial Fire Drill,” that caught Dr. Phil’s attention, as it aligned with his on-stage format. He invited Warren and her daughter to come onto his show to offer advice. And on March 10, 2004, under the show titled “Going for Broke,” Dr. Phil introduced Warren and her daughter to his TV audience and asked them to give advice directly to debt-troubled couples right in the studio. This was a whole new ball game for Elizabeth Warren, who would later see the magical powers of television.

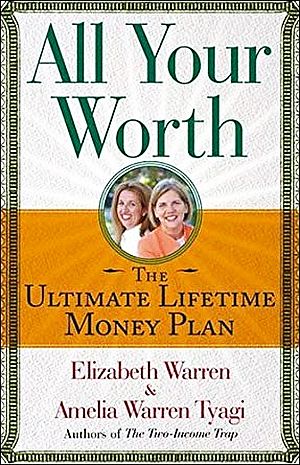

After her first show, Dr. Phil gave Warren some advice, telling her that The Two-Income Trap was good but “too technically intense.” and she needed to write another book like it, but make it more people friendly. Warren and daughter took the advice, quickly producing All Your Worth, published in March 2005. This book was even more popular and accessible than The Two Income Trap, as it spoke generally to the audience that Dr. Phil’s show had exposed her to — distilling the complicated topics she had studied as an academic into TV-ready offerings. An outspoken critic of America’s credit economy, Warren honed in on credit debt and rising middle-class bankruptcies. Banks were increasingly learning to trap people in costly debt cycles, she would explain, partly by just confusing them. “For Bank of America’s credit card in 1980,” she would explain, “the agreement was 700 words long. The average credit-card agreement by the mid-2000s was 30 pages long, and it was loaded with ‘double-cycle billing’ and ‘LIBOR-linked’ terms [international banking rates] no one understood.” The effect, Warren concluded, was akin to predation, not just for those with bad credit, but for the entire middle class, which she felt was being hollowed out by agreements most people didn’t understand.

All Your Worth made the bestseller lists of the New York Times, the Wall Street Journal and USA Today. The Washington Post called it “eye-opening,” and the Dallas Morning News, “the best explanation to date” for why Americans felt like they were working more and making less. Newsweek proclaimed it “provocative.” Warren would make two other appearance on Dr. Phil in 2004-2005. And it wasn’t just Dr. Phil, as Warren also began appearing on NBC, CBS, CNN and NPR. In her media spots, Warren came across as someone who knew her material, and was good on her feet and could turn a good phrase. She was learning the power of TV: a few minutes on Dr. Phil was more effective than a year in academia.Still, Warren continued her academic writing. In 2004, Warren published an article in the Washington University Law Review in which she argued that correlating middle-class struggles with over-consumption was a fallacy. Her expertise was now sought out in more televised venues. She appeared that year on a nationally-televised Frontline PBS documentary titled “The Secret History of the Credit Card.”

Warren was also edging back into the Washington political realm. At the end of April 2004, Senate Democrats convened a two-day conference on Maryland’s Eastern Shore to discuss economic issues. She had been invited for a panel on the middle class after an aide to Senator Harry Reid had discovered The Two-Income Trap. On the panel, “How the Middle Class Is Being Squeezed By Bush’s Economic Policies,” Warren in particular had brought the subject to life. Senator Harry Reid, according to one aide, “came away very impressed with her ability to break down complex economic arguments, in a way that voters could understand, basically.” North Dakota Democrat, Senator Byron Dorgan, no slouch on economics, was also impressed. “A superb communicator,” he said of Warren. “Some people are very good at that, and others know the subject and start at A and finish at Z and everybody’s asleep, you know?” Warren also did some of her own advance work that year – pushing The Two-Income Trap into the 2004 presidential campaign, contacting Democratic candidates John Edwards, Dick Gephardt and Howard Dean. Senator John Kerry called the book one of the best on describing “the transformation that has taken place in America.”

February 2005. Elizabeth Warren testifying before Senate Banking Committee on bankruptcy reform bill and tangling with then committee chairman, Sen. Joe Biden.

Other banking and finance work followed for Warren. In 2006, she appeared on a 60 Minutes segment investigating Sallie Mae and student loan debt. In 2007 she had penned a detailed piece on why a federal Consumer Financial Protection Agency — her brain child, like the Consumer Product Safety Agency – was needed to protect consumers, ferret out the “tricks and traps” of financial products, and prosecute the bad guys. Afterall, she argued, there were baseline safety protections and oversight for almost every kind of consumer product imaginable – from autos to food, toys to TVs – but there were no equivalent protections for consumer credit and financial products. A watchdog agency dedicated to this arena, she believed, would better regulate mortgages, student loans, credit cards and other financial products. More on that front would come a few years later.

Sept 19, 2008. Washington Post front page showing Hank Paulson, Nancy Pelosi, and Ben Bernake as TARP is formulated to rescue the economy.

But then, in late summer 2008, Wall Street began its meltdown.

Congress Calls, Pt. 2

Warren’s earlier research and analysis of what had been happening in bankruptcy and credit finance in the 1980s and 1990s, figured into the mix of factors contributing to the collapse of 2008. No surprise then that Senator Harry Reid called her that November, two months after Congress had fashioned the Treasury Department’s $700 billion Troubled Asset Relief Program (TARP). She was Reid’s pick to join the Congressional Oversight Panel (COP) that would oversee TARP. Warren wasn’t sure of what powers the COP would have, but her instincts and methods would soon prove their worth.

The COP was charged with reviewing the state of the markets, current regulatory system, and the Treasury Department’s management of the TARP. The panel was required to report their findings to Congress every 30 days, and would prepare other special reports as well. The panel consisted of five outside experts – one chosen by the Speaker of the House, then Nancy Pelosi (D-CA) ; one by House minority leader, then John Boehner (R-OH); one by Senate the majority leader Harry Reid (D-NV); one by then Senate minority leader (Mitch McConnell (R-KY), and one jointly chosen by Pelosi and Reid. All members were chosen by mid-November 2008 and the COP held its first meeting on November 25, 2008, when Elizabeth Warren was elected chairperson. The COP not only held its own hearing, but its members, and Warren, would also testify before various House and Senate committees to update them on what they were finding.

Dec 10, 2009. Congressional Oversight Panel at Capitol Hill hearing, (L-R) Paul Atkins, Chair, Elizabeth Warren, Damon Silvers, and Richard Neiman, evaluating whether TARP was helping nation’s financial situation. Photo, Alex Wong.

It wasn’t long before Warren made her presence felt. Early on, she tangled with Hank Paulson, Treasury Secretary under George Bush and the first administrator of TARP. Warren exposed that the initial round of TARP money under Paulson was a $78 billion giveaway to Wall Street’s most reckless banks, not, as Paulson had claimed, a fair exchange of cash for equity. Warren appeared on the CBS Early Show in early March 9, 2009 to talk about how Paulson misled the COP, among others, in making her charge. Warren was also getting other media attention.

C-SPAN – the important cable sponsored TV network that covers Congress and all things policy and political – covered the COP and Warrren’s various appearances elsewher on Capitol Hill. allowing snippets of her statements to be used by news outlets and others, some finding their way to YouTube and beyond. Her questioning Treasury Secretary Henry Paulson and later, Obama’s Treasury Secretary, Timothy Geithner showed her asking tough questions.

The Daily Show

On March 22, 2009, she appeared in a NBC-TV Dateline show, “Inside the Financial Fiasco: Mortgage Madness.” And on April 15, 2009, Warren appeared on The Daily Show with Jon Stewart to explain how much taxpayer money Wall Street received and what they had done with it. And she actually did a lot more than that – providing a quick but very effective overview on the U.S. history of banking and finance regulation, and how various strands of this critical regulatory network in recent years started to be pulled apart by the powers that be, and that’s when things started to go bad. Here’s a bit of what she laid out (click on image at right for video version of below excerpt):Warren: …Let me start that question in 1792. Okay, young country, George Washington is in his first term, and we have a credit freeze. There’s a financial panic. Every 10 to 15 years, there’s a financial panic in our history. You just look at it. And there’s a big collapse, big trouble, people lose their farms, wiped out. Until we hit the Great Depression. We come out of the Great Depression [and] we say, ‘you know, we can do better than this. We don’t have to go back to this kind of boom-and-bust cycle.’ We come out of the Great Depression with three regulations: [1] FDIC Insurance — it’s safe to put your money in banks; [2] Glass-Steagall [Act of 1933] — banks won’t do crazy things [with depositors money, like wild investments]; and [3] Some SEC regulations [i.e., regulation of stock trading]. We go 50 years without a financial panic, without a crisis —

Stewart: A couple of recessions, and then, there are some down times.

Warren: But no crisis. No banks failing. You know, no big crisis like that.

Stewart: S&L [i.e. Savings & Loan bank failures], that sort of thing.

Warren: …Well, now, wait a minute: I said fifty years, because then what happens is we say, “Regulation? Ahh, it’s a pain, it’s expensive, we don’t need it.” So we start pulling the threads out of the regulatory fabric, and what’s the first thing we get? We get the S&L crisis [1980s-1990s], 700 financial institutions failed. Ten years later, what do we get? Long-Term Capital Management [highly leveraged hedge fund failure, late 1990s], when we learn that when something collapses one place in the world, it collapses everywhere else. Early 2000’s, we get Enron, which tells us the books are dirty. And what is our repeated response? We just keep pulling the threads out of the regulatory fabric.

Warren: So we have two choices. We’re gonna make a big decision, probably over about the next 6 months. And the big decision we’re gonna make is, it’s gonna go one way or the other. We’re gonna decide, basically, “Hey, we don’t need regulation. “I don’t know what you did just there, but for a second that was like financial chicken soup for me. Thank you….” -Jon StewartYou know, it’s fine: boom-and-bust, boom-and-bust, boom-and-bust — and good luck with your 401(k).” Or alternatively, we’re gonna say, “You know, we’re gonna put in some smart regulation that’s going to adapt to the fact that we have new products.” And what we’re gonna have going forward is, we’re gonna have some stability and some real prosperity for ordinary folks.

“That is the first time in six months to a year that I felt better,” Stewart said after Warren summed up the financial history. “I don’t know what you did just there but for a second that was like financial chicken soup for me. Thank you. That actually put things in perspective that made a little sense…” Warren’s national profile notched up a little bit more after that and other TV appearances.

C-SPAN excerpts of her grilling of public officials began appearing on YouTube helped move her into the national spotlight. She was articulating the outrage of millions of Americans, some of whom lost their homes while bankers were being bailed out.

Warren surprised members of her own staff when she began using the nearby Senate recording studio to produce monthly videos of her COP reports. She and staff also created a comprehensive website with a regularly updated blog – this at a time when such digital tools weren’t widely used by members of Congress. But she also received a few friendly warnings: the COP’s printed reports were “far too direct,” one Capitol Hill aide told her, not hedged in the language politicians were accustomed to.

2009. U.S. Treasury Secretary Timothy Geithner being questioned by Elizabeth Warren at Sept 2009 hearing. Click for C-SPAN video.

Geithner and other Obama administration officials would appear before Warren and the COP on other occasions, and her questioning was so direct at times that it stunned some of the Republicans on the COP panel. Geithner, for one, according to some sources, would not forget his encounters with Warren. She was also critical of the banks and the Obama administration on Fox and Friends, in the New York Times, and in Michael Moore’s 2009 documentary Capitalism: A Love Story.

Warren was not in Washington to win any popularity contests, and she said as much, then believing her COP stint a one-time political appointment. “I have no future in this… I have lifetime tenure [at the Harvard Law School]. What are you going to do to me?,” she told the Boston Globe in late 2009. Her rising notice made her a media favorite, called to TV news and talk shows. She also appeared in documentaries – among them, two PBS/Frontline shows: “Breaking the Bank” in June 2009 (on the banking crisis and what COP was doing) and “The Card Game” in November 2009 (how banks and credit card companies were reacting to new government regulations). And there were other media appearances, as well, including a return to John Stewart’s The Daily Show in late January 2010.

And while Warren and others sought financial reform in Washington, banks and other business interests on the other side were not standing still. According to the Center for Public Integrity, from 2009 through the beginning of 2010, more than 850 businesses and trade groups paid lobbyists $1.3 billion to fight financial reform.

May 2010. Time magazine cover showing Warren as one of three women – with Mary Schapiro, Sheila Bair – dubbed “The New Sheriffs of Wall Street,” to “clean up the mess” and regulate banking and finance.

Warren, for her part, was then also working with then Congressman Barney Frank (D-MA) and Senator Chris Dodd (D-CT) to hammer out the Dodd-Frank financial-reform legislation in June of 2010.

Barney Frank gave her high marks in the process. “When we actually got into the legislative drafting, she was unusually good for someone who wasn’t involved with the political process.” She exhibited “tactical flexibility,” Frank explained, “ordering priorities, fighting for the ones you think are most important, and being willing to compromise on others.”

Warren used her new platform to lobby for the creation of the Consumer Financial Protection Bureau, the watchdog agency she had advocated three years earlier to better regulate mortgages, student loans, credit cards and other financial products. The U.S. Chamber of Commerce promptly announced that it would spend “whatever it takes” to defeat Warren’s proposal. At least $3 million in Chamber advertising was thrown into the fray. Still, after much political wrangling, the new consumer agency was authorized under the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010. On September 17, 2010 President Obama appointed Warren as assistant to the president and special adviser to the Treasury secretary in order to set up the new Consumer Financial Protection Bureau.

But behind the scenes in the White House, there was some difficulty with Warren and the new agency – chiefly the fact that Republicans and Wall Street were loaded for bear should Obama try to nominate Warren as the agency’s first director. His temporary middle ground was the September 2010 naming of her as an assistant to the president and special adviser to Treasury Secretary Geithner while she staffed the agency, delaying the decision to name a director.

September 17, 2010. President Barack Obama appoints Elizabeth Warren as assistant to the president and special adviser to the Treasury secretary Timothy Geithner to launch new Consumer Financial Protection Bureau.

There had been an impressive array of support for naming Warren: the AFL-CIO, scores of consumer groups, numerous newspaper editorials. bloggers galore, and several hundred thousand people and organizations signing White House petitions to the on her behalf. Yet the other side was out in force – Wall Street finance, most Republicans, and also some Democrats, including some in Obama’s own White House – all blocking her chances. Timothy Geithner for one, having been roughed up a time or two before Warren’s oversight panel, was privately not a big fan. Obama was also running for a second term, and had Wall Street campaign money to consider.

On May 2, 2011, more than 40 Republican senators sent a letter to Obama, citing “the lack of accountability in the structure” of the CFPB, and that its director had “unprecedented authority” over financial institutions and main street businesses.” They promised to block confirmation of anyone nominated to direct the CFPB unless the bureau’s structure was overhauled.

In July 8th 2011, nearly a year after Obama had signed the Dodd-Frank bill and after Warren had spent 10 months setting up the CFPB with 500 staff ready to go, Obama in the Rose Garden, nominated former Ohio Attorney General, Richard Cordray, to lead the CFPB. Warren had already brought Cordray to the CFPB as its chief enforcement officer. Still, Cordray’s nomination would face some difficult political fights before being finally confirmed.

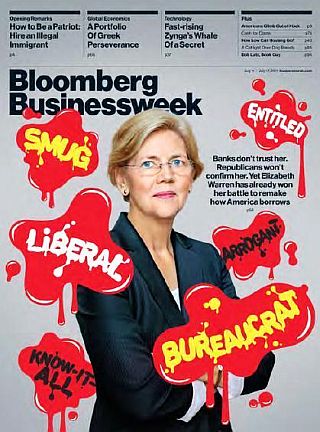

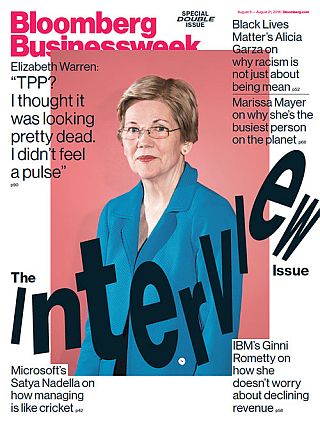

July 11, 2011. Elizabeth Warren, under siege, on the cover of “Bloomberg BusinessWeek” magazine

Obama would send advisor David Axelrod to informally meet with Warren and her husband about the idea. Senators Harry Reid and Chuck Schumer also lobbied her, promising to help with experienced campaign teams. Warren’s national profile, and likely ability to raise money, suggested she was an ideal recruit for the Democrats’ top Senate target in 2012. Still, she mulled it over.

Warren, wherever she went, would likely continue to be a target of Wall Street and big business.

A July 2011 edition of Bloomberg Businessweek magazine, a popular Wall Street and New York financial and business magazine produced by Mike Bloomberg’s empire, issued the cover image of her at left with its spattering of critical epithets and tagline that read: “Banks don’t trust her. Republicans won’t confirm her [for the CFPB]. Yet Elizabeth Warren had already won her battle to remake how America borrows.” But some insiders in the Administration and on Capitol Hill felt Warren had gotten “a little ahead of her skis,” as it were, ruffling delicate egos with her directness and hard-charging ways.

Nevertheless, Warren, with her straight talk and media appearances had become something of a populist hero. And by August 2011, she began moving toward elective office with a “listening tour” in Massachusetts to explore making a run for the U.S. Senate.

What She Knows

From the more liberal press, meanwhile, Vanity Fair magazine of November 2011, offered a feature piece on Elizabeth Warren by Suzanna Andrews which explored the Wall Street and Republican efforts to keep Warren out of power – then to keep her from leading the Consumer Financial Protection Bureau. But the key thesis of this Vanity Fair piece was to highlight what Warren knew about how Wall Street finance really worked – and her ability to communicate the arcane practices of high finance plainly to the public and in the policy arena. Warren’s knowledge about the world of banking and finance was what the Wall Street gang and their accomplices in Washington feared most about her. “Keep Warren out at all costs,” was essentially their mantra and main goal.

November 2011. First two pages of a Vanity Fair story on Warren, “The Woman Who Knew Too Much,” recounting her struggles with the Obama Administration, various political friends and enemies, and Wall Street financial opponents in the battle over the Consumer Financial Protection Bureau and her bid to lead it. Click for story.

Warren “knew what she was talking about,” explained Andrews in her article, noting that Wall Street’s power in Washington, “was built partly on the fact that few people outside Wall Street understand the esoterica of finance—the intricacies of C.D.O.’sShe knew the secret hand-shake, the secret language. [collateralized debt obligation, a structured finance product] and the labyrinthian structures of credit-default swaps.” That knowledge, “is used to control and confuse,” explained Andrews. But it didn’t confuse Warren. Rep. Carolyn Maloney (D-NY), quoted in the piece, said of Warren: “She understands the information as well as the top players in the business.” Warren knew “the secret handshake, the secret language,” as Andrews put it, and she used it against the Wall Street CEOs and Washington’s movers and shakers. And that’s why the Wall Street financial gang did all in their power to keep her from running the Consumer Financial Protection Bureau. But by the time of her bid for the U.S. Senate, they would come at her again.

Senate Race

2012. "Warren For Senate" logo.

But at a campaign event in Andover, MA about a week after Warren’s announcement, it became clear that Warren had something to say that could resonate in Massachusetts and beyond. There, at a private residence with an overflowing crowd, Warren gave a rousing defense of liberal economics, responding to a charge that asking the rich to pay more taxes was “class warfare.” She also made clear how “public goods” supported private gain:

There is nobody in this country who got rich on his own. Nobody. … You moved your goods to market on the roads the rest of us paid for; you hired workers the rest of us paid to educate; you were safe in your factory because of police forces and fire forces that the rest of us paid for. You didn’t have to worry that marauding bands would come and seize everything at your factory, and hire someone to protect against this, because of the work the rest of us did. Now look, you built a factory and it turned into something terrific, or a great idea. God bless. Keep a big hunk of it. But part of the underlying social contract is, you take a hunk of that and pay forward for the next kid who comes along.

Parts of this Warren speech was video taped by an attendee and put on YouTube where it went viral. Political wags learning of this agreed that Warren had tapped into something that could go beyond Massachusetts and have a national appeal. Even Obama would later use a bit of Warren’s message in his own 2012 re-election campaign.

April 2012. Conservative National Review magazine features U.S. Senate hopeful Elizabeth Warren as the “occupy candidate” re Wall Street protests at the time.

Sheila Bair, the former chair of the Federal Deposit Insurance Corp. and a lifelong Republican, endorsed Warren in the Massachusetts race. Bair had worked with Warren, during the financial crisis and in its aftermath, and in early November 2012, before election day, Bair did an interview on CNN during which she had high praise for Warren.

“We probably don’t agree on all the fiscal issues,” Bair said. “But on financial reform, we do. Most importantly, I think she’s a person of integrity who is going to be independent … And we need more independent thinkers like that in Washington, people who will be independent of special interests…. I know Elizabeth well…She’s really, she’s just whip-smart and she’ll be a player from day one if she gets elected.”

On the Senate campaign trail, Warren would repeat her economic charges, born of years-long research: that middle-class families were getting hammered and that Washington doesn’t get it. “G.E. doesn’t pay any taxes,” she would say, referring to the giant corporation, General Electric, “and we are asking college kids to take on even more debt to get an education, and asking seniors to get by on less. These aren’t just economic questions. These are moral questions.”

Opinion polling indicated a close race between Warren and Brown, though Warren opened up a small lead in the final few weeks. She went on to defeat Brown by over 236,000 votes, 54 percent to 46 percent. Warren also raised $39 million — more than any other Senate candidate in 2012, and showed, according to the New York Times, “that it was possible to run against the big banks without Wall Street money and still win”.

Jan 2013. Senator Warren in ceremonial swearing-in photo with husband Bruce Mann and Vice President Joe Biden. |

June 2014. Warren with Senators Richard Durbin (D-IL), Patty Murray (D-WA), Chuck Schumer (D-NY) at Capitol Hill news conference on college affordability. |

Sept 2014. Senator Warren at Capitol Hill rally for senior citizens. |

In The Senate

Taking her seat in the U.S. Senate, Warren was assigned to three committees: the Banking, Housing, and Urban Affairs Committee; the Health, Education, Labor, and Pensions Committee; and the Special Committee on Aging. She wasted little time getting to work. At her first Banking Committee hearing in February 2013, she asked banking regulators when they had last taken a Wall Street bank to trial, adding: “I’m really concerned that ‘too big to fail’ has become ‘too big for trial’.” Videos of Warren’s questioning went viral, amassing more than one million views in a matter of days.

In March 2013, she asked Treasury officials why criminal charges were not brought for money laundering against multinational banking and investment giant, HSBC ( holding company for world’s 7th largest bank, established in London by the Hongkong and Shanghai Banking Corporation). “If you’re caught with an ounce of cocaine,” she observed, offering a street crime contrast, “the chances are good you’re going to go to jail … But evidently, if you launder nearly a billion dollars for drug cartels and violate our international sanctions, your company pays a fine and you go home and sleep in your own bed at night.”

Warren also used the power of her Senate office to pressure federal agencies. In May 2013 letters to the Justice Department, the SEC, and the Federal Reserve, Warren questioned their decisions to settle cases rather than prosecute in court. Legislatively, she introduced a number of new bills, among them, in May 2013, the Bank on Student Loans Fairness Act, proposing that students should get “the same great deal that banks get” – i.e., 0.75 percent, the rate banks were then paying to borrow from the federal government.

November 2013 - New Republic story on how Democrats were beginning to see Warren as a party favorite.

Rising Democrat

Through 2013 and 2014 there was continued coverage of Warren’s rising in the Democratic ranks, even as a possible alternative to then Senator Hillary Clinton, the likely Democrat to run for president in 2016.

By September 2013, bumper stickers and T-shirts began surfacing in liberal enclaves proclaiming, “I’m from the Elizabeth Warren Wing of the Democratic Party.” In October 2013, however, Warren joined the other 15 female Democratic senators in signing a letter that encouraged Hillary Clinton to run for president. Still, The New Republic magazine in November 2013 ran a cover full of Warren faces with the tagline, “Hillary’s Nightmare: A Democratic Party That Realizes Its Soul Lies With Elizabeth Warren Instead.”

In late April 2014, Warren’s memoir, A Fighting Chance, was published. The book’s title refers to a time, Warren says, that is now gone; a time when families of modest means who worked hard and played by the rules had at a fair shot – a fighting chance – at the American dream. The book received positive reviews.

The New York Review of Books called it “A revealing account of Warren’s rise to prominence…[Her] arguments demand to be taken seriously….As a politician and activist, Warren’s great strength is that she retains the outsider’s perspective, and the outsider’s sense of moral outrage, which runs throughout A Fighting Chance…”

The Pittsburgh Post-Gazette’s review called it: “Passionate… Her vision [for the country], laid out elegantly and effectively in A Fighting Chance, involves investments by ‘we the people,’ through our government, in schools, roads and research labs, and in a social safety net for ‘the least among us,’ investments that are, at once, in our own self-interest and in the national interest.” Booklist gave it a starred review, noting in part: “…[Warren] offers a behind-the-scenes look at the political dealmaking and head-butting machinations in efforts to restore the nation’s financial system.” The book became a New York Times bestseller, with Warren making the rounds on the talk shows.During the 2014 mid-term elections, Warren became a top Democratic fundraiser, and later that fall was appointed as Strategic Adviser of the Democratic Policy and Communications Committee, adding to speculation she would run for president in 2016. But during a December 15, 2014 interview with NPR’s Steve Inskeep, Warren repeated four times that she was not running for president in 2016.

In early June 2015, during her first term as Senator, Warren sent a scathing June 2, 2015 letter to Mary Jo White, head of the Securities and Exchange Commission (SEC), saying “I am disappointed by the significant gap between the promises you made during and shortly after your confirmation and your performance as SEC Chair.”

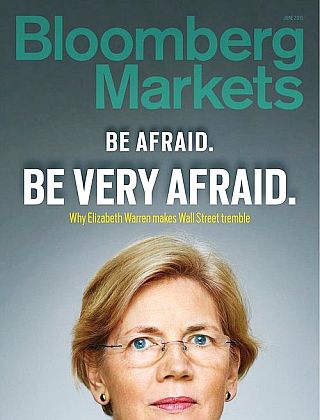

Also in June 2015, came a somewhat backhanded compliment of Warren’s rising economic-political notice with the cover of a Bloomberg Markets business magazine, which circulates on Wall Street and among the Fortune 500. The headline used – run above a head shot of Warren – made no bones about its message: “Be Afraid. Be Very Afraid. Why Elizabeth Warren Makes Wall Street Tremble.”

June 2015. “Bloomberg Markets” cover & tag line: “Be Afraid. Be Very Afraid. Why Elizabeth Warren Makes Wall Street Tremble.” A badge of honor?

Warren was then in her continuing fight with big banks and financial institutions, none happy with the reforms she was seeking. Wall Street was then trying to rollback financial regulation established under the Dodd-Frank law of 2010, but Warren was in the way. Income inequality was also a rising issue, another of Warren’s central concerns. Americans were still angry about the financial crisis, and Warren was one of their more vocal champions in the U.S. Senate. On the floor of the Senate, Brooker noted, Warren called out financial giant Citigroup, acknowledging that the Dodd-Frank law put into effect after the 2008 crash wasn’t perfect, adding: “It should have broken you into pieces” – meaning a break up of big banks like Citi.

“Warren turned Citi into exactly the kind of villain so many people suspect lurks in the backrooms of the Capitol,” Brooker wrote. “In one particularly striking moment, she connected nine top government officials—including Treasury Secretary Jacob J. Lew—directly to the megabank. She invoked Teddy Roosevelt, her favorite trust-busting president, who took on the big corporations of his day.” Brooker’s story also looked at Warren’s ability to dig out tiny legislative details important to big banks and financial institutions — “obscure items tucked away in the middle of 1,600-page spending bill in Congress — and then call attention to the provisions as an unfair giveaway to the wealthiest one percent.”

Yet, casting shade on Ms. Warren’s professed intentions as the cover of Bloomberg Markets did with its June 2015 cover – might be stating the very reasons why a national leader with views like hers should be president: if Wall Street doesn’t like what she’s about, that’s probably a good reason for the 99 percent to join her crusade.

July 2015. Time magazine cover asked,“Who’s Afraid of Elizabeth Warren?”

Also that month, the July 9, 2015 issue of Time magazine, shown at right, ran a cover story entitled, “Who’s Afraid of Elizabeth Warren?” Those “afraid” in this story were Wall Street Democrats – and more pointedly, Hilary Clinton Democrats. The piece inside the magazine, by Micheal Scherer, was titled “How Elizabeth Warren’s Populist Fury is Remaking Democratic Politics.” It picked up from the cover tagline that explained of Warren: “She’s hounding Obama, haunting Hilary and paving the way for Bernie Sanders. How She’ll shape the 2016 race.”

During late 2014-and through 2015, Warren had picked fights with her own party, not all of which were well received. In December 2014, she attacked the White House and Democratic leaders for agreeing to roll back limits on derivatives trading by federally-insured banks. She called out Obama advisers involved with Citigroup, one of the major proponents of the change. Antonio Weiss, an Obama-nominated Wall Street investment banker slated for the No. 3 spot at Treasury, was blocked by Warren and forced to withdraw. Larry Summers, a top economic aide to both Obama and Clinton – and also a former consultant to Citibank – was blocked by Warren and other Democrats from becoming Chairman of the Federal Reserve. She also raised issues with an Obama trade deal, telling progressive activists in mid-June 2015, “he won’t let you see the deal,” adding, however, that “big corporate interests” were getting to see the drafts. Also during the summer of 2015 Warren launched a broadside against Mary Jo White at the Securities and Exchange Commission chair, criticizing White’s delay of new rulemaking for the finance industry, and raising conflict-of-interest matters related to White’s husband who worked at a Wall Street law firm.

Elizabeth Warren received lots of interest in a possible 2016 presidential run, but decided to support Hillary Clinton. Illustration, The Nation / Andy Friedman.

Still, Elizabeth Warren’s Washington agenda remained ambitious – wanting, among other things, to break up the big banks, increase funding for Social Security, and slow the revolving door between the White House and Wall Street. But now, she was increasingly seen as a potential presidential candidate.

There had been heavy speculation for some time that Warren would mount a challenge to Hillary Clinton for the 2016 democratic presidential nomination. In fact, in early 2015, Joe Rospars, Obama’s former online fundraising strategist, sent Warren an unsolicited memo predicting, based on her past performance and then support, that she could raise more than $100 million online through the first quarter of 2016, adequate to mount a serious challenge to Clinton. But Warren declined, deciding she could accomplish more by fighting in the Senate,

October 2016. Senator Elizabeth Warren campaigning for Presidential candidate Hillary Clinton in Manchester, NH.

Warren would actively campaign for Clinton through that fall and delivered the nationally-televised keynote address on the first night of the Democratic National Convention in Philadelphia on July 25, 2016, the third woman in history along with Texas Representative Barbara Jordan and Texas Governor Ann Richards to be given that spot. Warren took the opportunity to draw clear distinctions between Clinton and her opponent, Donald Trump. Then came speculation about Warren being added to the Democratic ticket as a vice-presidential candidate. On July 7, 2016, CNN reported that Warren was on a five-person short list to be Clinton’s running mate. Clinton eventually chose Tim Kaine.

In the business press, meanwhile, the activities and outlook of Senator Warren were still of keen interest. Interviewed in Bloomberg BusinessWeek of August 2016, here’s a bit of what she then had to say when quizzed on the Glass-Steagall Act:

2016: Senator Warren being interviewed by Bloomberg Businessweek, August 8-21, 2016.

A: I am delighted to see people of all political views engage on the Glass-Steagall issue. I think most Americans get this one: that there’s plain old basic banking, checking, savings accounts, and then there’s more speculative, high-risk banking. And those two should not be joined together. That’s what Glass-Steagall is principally about, and that’s why I think we’re seeing so much support for it all around the country.

Q: Are you surprised Trump is pushing it? He doesn’t strike me as someone who’s given deep thought to financial reform.

A: I’m not sure Donald Trump gives deep thought to much of anything. But on financial reform, it’s really hard to miss the Glass-Steagall issue. I get up and talk to people who are not very politically connected, and I say “Glass-Steagall” and get a big cheer. I think that because it’s not a distant, technical issue, it’s something that people can feel and understand.

Finance serves two functions: basic banking, moving around your money through checking accounts. And that needs to be rock-solid pure. That’s why banks get a monopoly to do that and why there’s FDIC insurance. In effect, banks get to do that in return for modest but steady profits. This whole business around using some of those funds, backstopped by an FDIC guarantee, to get out there and engage in speculative financial transactions seems fundamentally wrong to most people. I think that’s why it’s an idea whose time has come again. John McCain and I have submitted a Glass-Steagall bill…

Wells Fargo Grilling

September 2016. Senator Warren during questioning of Wells Fargo CEO John Stumpf, with documentation in hand, Click for C-SPANN video.

A poster sample of some of the “neverthelss-she-persisted” material that followed Senator Warren’s Senate rebuke of February 2017.

In February 2017, during Senate debate on President Trump’s nomination of Senator Jeff Sessions for U.S. Attorney General, Warren, in a floor statement, quoted a letter Coretta Scott King had written in 1986 when Sessions was nominated for a federal judgeship.

King wrote, “Mr. Sessions has used the awesome power of his office to chill the free exercise of the vote by black citizens in the district he now seeks to serve as a federal judge. This simply cannot be allowed to happen.”

Senate Republicans voted that by reading the letter from King on the Senate floor, Warren had violated Senate rule 19, which prohibits impugning another senator’s character. This prohibited Warren from further participating in the debate on Sessions’s nomination.

On the floor, explaining the Senate vote and prohibition, Senate Majority Leader Mitch McConnell, stated, “…She was warned. She was given an explanation. Nevertheless, she persisted.” McConnell’s language in this last phrase became a viral meme on behalf of Warren and generally for women’s persistence in breaking through barriers, despite being silenced or ignored.“Nevertheless, she persisted” was posted widely on social media with various hashtag references. And shortly thereafter, there were all kinds of t-shirts, posters, and other items with some version of the phrase being used.

“If the Republican senators had intended to minimize Warren’s message,” wrote Amy Wang in the Washington Post, “the decision backfired—severely. Her supporters immediately seized upon McConnell’s line—giving Warren a far bigger megaphone than if they had simply let her continue speaking in what had been a mostly empty chamber, some pointed out.” Warren, meanwhile, read King’s letter elsewhere, streaming it live online.

April 2017. Warren’s book “This Fight Is Our Fight,” is published, Metropolitan Books, 352pp. Click for copy.

In the New York Times Book Review, Paul Krugman, Noble prize winning economist, professor, and columnist, wrote of Warren’s book: “This Fight Is Our Fight is a smart, tough-minded book….What Democrats need right now is a reason to keep fighting. And that’s something Warren’s muscular, unapologetic book definitely offers. It’s an important contribution.”

The New York Journal of Books added: “This Fight Is Our Fight provides an insider’s look at the machinations that are undermining the U.S. economy and political system. Warren spells out what is happening and what needs to be done to reverse the slide….Warren is outspoken, personable, emphatic, dedicated… It is unusual for any politician to be so open.”

At Amazon.com, the book has received hundreds of customer reviews, many giving it a top rating. It also became a New York Times bestseller, published in paperback and Kindle editions.

In 2018, Warren ran for re-election to the U.S. Senate and in November easily won a second term, defeating Republican nominee, Geoff Diehl, 60 percent to 36 percent. Even before she had officially won that election, Warren had signaled at a town hall meeting in Holyoke, Massachusetts on September 29, 2018 that she would later “take a hard look” at running for president in 2020. Two months later, at the end of December 2018, she announced she was forming an exploratory committee to run for president, followed in February 2019 with her official candidacy for president at a rally in Lawrence, Massachusetts. A longtime critic of President Trump, Warren called him a “symptom of a larger problem [that has resulted in] a rigged system that props up the rich and powerful” at the expense of everyone else. “It won’t be enough to just undo the terrible acts of this administration,” she said at the rally. “We can’t afford to just tinker around the edges—a tax credit here, a regulation there. Our fight is for big, structural change….”

Feb 2019, National Review. |

March 2019, The Nation. |

April 2019, Politico. |

May 2019, Time. |

Oct 2019, National Review. |

Oct-Nov 2019, Economist. |

Through 2019, as she mounted her bid for the Democratic Presidential nomination and the primary fight, Elizabeth Warren has received continued scrutiny and “cover girl” treatment from both the left and the right. Some magazine cover images, for example, are included at left.

The cover illustration for Jonah Goldberg’s story in the February 7th, 2019 edition of National Review on “the dangers of the progressives’ favorite shibboleth: The Moral Equivalent of War’,” included caricatures of “Green New Deal” supporters, Bernie Sanders, Elizabeth Warren, and Rep. Alexandria Ocasio-Cortez (D-NY), all shown in military attire, lobbying motors at some unseen enemy.

From the left, The Nation magazine’s cover of March 2019 showed Warren punching a small cartoon likeness of Donald Trump for its story, “A Fighter From Within: Elizabeth Warren Isn’t Scared of Trump—or Her Own Party,” by R. Sikoryak.

Politico magazine, for its April 12, 2019 “Friday cover” issue, explored Warren’s Republican years.

Time magazine of May 2019 featured a cover story on Warren’s presidential bid, including brief summaries of some of her much-touted policy plans.

National Review, several months later, in October 2019, also did their take on Warren’s plans with a Warren cartoon caricature on the cover along with tagline: “She’s Got A Wretched Plan For That.”

The Economist of October 24, 2019 also put Senator Warren on its cover with its feature story: “Elizabeth Warren’s Plan To Remake American Capitalism.”

Structural Change

Elizabeth Warren campaigning, U.S. News/Matt York/AP.

Among her proposals are those that would overhaul private equity, get big money and donors out of politics, jail guilty corporate executives, and implement a lobbying tax — and more.

Warren has touted her anti-corruption package – aimed primarily at corporate influence and special interest power in Washington, DC. – as among her first steps.

“Corruption has put our planet at risk. Corruption has broken our economy. And corruption is breaking our democracy,” Warren has said. “I know what’s broke. I’ve got a plan to fix it…”

And again, by “corruption” she means the fine print of law in thousands of provisions; fine print put there by the favored interests; provisions of law that need to be either removed or democratized so that the “one-percent skew” is no longer a factor. Warren – and the people she will bring with her – will work at democratizing the legal powers that shape the American economy.

On Wall Street

Should a Warren Administration take charge in January 2021, most of Wall Street and corporate America will not be among her leading supporters. But not everybody on Wall Street is at odds with what Warren has in mind. In fact, there are more Warren supporters in the financial and business sector than might be expected. Emily Stewart, writing for Vox.com in an October 2019 story titled, “The Wall Streeters Who Actually Like Elizabeth Warren,” noted for example:

…I spoke with more than three dozen people from across the financial sector — professionals who work at hedge funds, big banks, and private equity funds, in asset management, financial advice, investment banking, trading, research, and compliance — who support Warren’s presidential bid. They know if she lands in the White House that may make their jobs a bit different, their companies a little less lucrative, or mean they’ll pay more in taxes. And they think that’s great. They support Warren because of her policies, not in spite of them….

‘Even though, on a personal basis, Elizabeth Warren may be bad for me economically’ [one director at Citi told Stewart], she would be better for society, which I want my kids to grow up in’….

2018. Senator Warren being interviewed by "Mad Money" host, Jim Cramer on Wall Street.

“Mad Money”

And during her years unfurling bankruptcies, overseeing TARP, and as a U.S. Senator, Warren has never shied away from the business press. In fact, she has won over some of those analysts with her fair and thoughtful critiques. Among these have been Jim Cramer, the popular host of CNBC’s Mad Money TV show on the stock market.

Warren appeared on Cramer’s show several times, with Cramer admitting to colleagues at one point having a “soft spot” for Warren, believing her work was aimed at helping people. On a CNBC show of October 1, 2019, then reporting about Mark Zuckerberg’s reaction to Warren calling for the break up of big tech companies, Cramer felt the business community’s reaction to Warren was overblown. And he added: “I just want to stop the fear of Senator Warren. I really think that’s a mistake. I also don’t think she’s nearly as anti-business [as she’s made out to be]… I also think that some of these bank stocks are so bad I wish they’d break them up.”

2020 "Warren-For-President" campaign button.

A key part of Warren’s platform, and how she would pay for a variety of social programs – child care, student debt forgiveness, black colleges, improved public education, and others – is a two- tax proposal aimed at the extremely wealthy. The first is a 7 percent tax on business profits exceeding $100 million. The second, a wealth tax aimed at the top one-tenth of the richest 1 percent of Americans – 2 percent tax on fortunes over $50 million, and 3 percent on fortunes over $1 billion. Together, these two taxes, by Warrren’s accounting, would raise $3.75 trillion over ten years. While there would likely be challenges to implementing these proposals, they are extremely popular with most Americans, as is Warren’s rationale for offering them, such that wealth and huge profits are made possible by taxpayer-supported “common goods” like public infrastructure, police and fire protection, etc.

Then, in the final analysis, there’s the matter of actually getting that broader swath of the American electorate to vote for Elizabeth Warren.

Trump-To-Warren?

Politico’s Michael Kruse offered one interpretation of that question in his November 30, 2018 story, “The Making of Elizabeth Warren”:

…One way to look at what happened in 2016 is Donald Trump stole Elizabeth Warren’s issue. He ran and won because lots and lots of people are struggling and falling behind, and they’re angry, and they’re right to be angry, say people on both sides of the political divide, because the economy, the system, this country, is not working for them. But Warren had started to figure this out all the way back […in 1981, when her bankruptcy work began]…And through the lens of bankruptcy she had her eyes opened to so many of the other factors making life more and more difficult for more and more people. The plight of the middle class has defined Warren’s life’s work. She has thought about them longer and harder than just about anybody anywhere. Trump saw them. Spoke to them. And he connected.

…One way to think about 2020, then, is this: How can she, or anybody else, for that matter, get them back?…

October 2019. Senator Elizabeth Warren at a Norfolk, Virginia campaign event. Photo, Zach Gibson.

Warren’s performance in the early Democratic primaries as of late February 2020 was mixed at best, but perhaps only because many voters had yet to understand what Elizabeth Warren already knew about the “rigged system” and what she might do about it as president.

Update. Although Warren had placed first in some Iowa primary polls in September and October 2019, and she drew huge early crowds during the primaries, she ended her campaign for the Democratic Presidential nomination on March 5, 2020, finishing behind Joe Biden and Bernie Sanders. Thereafter, she continued her duties in the U.S. Senate while supporting and helping raise money for other Congressional and Senate candidates through her “Warren Democrats” group, established for that and other purposes. She also became an advisor to Joe Biden during his Presidential campaign and was one of four finalists considered to be Biden’s Vice President. Kamala Harris was picked as Biden’s running mate on August 11, 2020.In the run up to Biden’s election in November 2020, there were press reports that Warren was interested in a possible Secretary of the Treasury position in a Biden Administration. Failing that, should the Democrats take control of the Senate, she might then make a run to chair the Senate Finance Committee or push for tough actions from that committee. Wherever she may end up, Elizabeth Warren will no doubt continue to advocate for “major structural change” in the economic system to redress imbalances that have straightjacketed most Americans. Stay tuned.

For additional stories at this website on politics, please see the “Politics & Culture” page and also two topics pages: “Democrats’ History, 1930s-2010s”, and “Republican History, 1950s-2010s”.

Thanks for visiting. And if you like what you find here, please make a donation to help support the research, writing and continued publication of this website. Thank you. – Jack Doyle

|

Please Support Thank You |

____________________________________

Date Posted: 27 February 2020

Last Update: 15 March 2023

Comments to: jdoyle@pophistorydig.com

Article Citation:

Jack Doyle, “Street Smarts: The Rise of Elizabeth Warren,”

PopHistoryDig.com, February 27, 2020.

____________________________________

Sources, Links & Additional Information

Teresa A. Sullivan, Elizabeth Warren, Jay Lawrence Westbrook, As We Forgive Our Debtors: Bankruptcy and Consumer Credit in America, Oxford University Press, 1989.

David Cay Johnston, “Narrowing the Bankruptcy Escape Hatch,” New York Times, October 4, 1998, p. 9.

“Five Questions for Elizabeth Warren,” New York Times, Sunday, September 3, 2000, p. 7.

Elizabeth Warren, Op-Ed, “A Quiet Attack on Women,” New York Times, May 20, 2002, p. 19.

Dr. Phil staff, “Going For Broke: Financial Advice – Dr. Phil Invites Elizabeth Warren and Amelia Warren Tyagi to Give His Guests Financial Advice,” DrPhil.com, 2003.

Elizabeth Warren Interview, Frontline/PBS, “Secret History of the Credit Card,” November 23, 2004.

“User Clip: Elizabeth Warren: Credit Card Industry Practices,” C-SPAN.org, Harvard Law School Professor Elizabeth Warren Before The Senate Banking Committee on Credit Card Industry Practices, January 25, 2007.

Elizabeth Warren, “Unsafe at Any Rate…Why We Need a Financial Product Safety Commission,” DemocracyJournal.org, Summer 2007, No. 5.

Elizabeth Warren, OP-ED, “Mortgage Brokers’ Sleight of Hand,” The Boston Globe, October 2, 2007.

David Barstow, “Treasury’s Oversight of Bailout Is Faulted,” New York Times, January 9, 2009.

“Elizabeth Warren Introduces the First Report of the Congressional Oversight Panel,” YouTube.com, posted by oversightpanel, December 11, 2008.

Melissa Block, “Expert: Few Clues On How Banks Used TARP Funds,” All Things Considered/NPR.org, February 11, 2009.

Thomas F. Cooley, “Elizabeth Warren’s Holy Crusade,” Forbes.com, April 22, 2009.

Catherine Rampell, “Elizabeth Warren on Consumer Financial Protection,” New York Times, June 17, 2009.

“Professor Elizabeth Warren, 2009 American Constitution Society (ACS) National Conven-tion, YouTube.com, posted by American Constitution Society, June 25, 2009.

Business, “Oversight Panel Chief on Stock Warrants (CNBC),” NewYorkTimes.com, July 10, 2009.

Business, “Oversight Panel Chief on TARP (CNBC),” New York Times, December 9, 2009 (w/video).

Jackie Calmes, “Geithner Finds Support, and Questions, on Handling Bailout,” New York Times, December 10, 2009.

Charles P. Pierce, “Bostonian of the Year: The Watchdog: Elizabeth Warren,” Boston Globe Sunday Magazine, December 20, 2009.

C-SPAN, “User-Created Clip: Elizabeth Warren [The Congressional Oversight Panel (COP)] Questions Timothy Geithner on TARP Bailout, Troubled Asset Relief Program Oversight Panel September 10, 2009,” CSPAN.org.

Jackie Calmes and Sewell Chan, “Obama Pressing for Protections Against Lenders,” New York Times, January 19, 2010.

Business/Dealbook, “Warren: Banks’ Sabotage of Overhaul Will Hurt Them,” New York Times, February 9, 2010.

Sewell Chan, “Concern Aired Over Banks’ Real Estate Loans” New York Times, February 11, 2010, p. B-2.

Cyrus Sanati, Business “Not Just for Laughs: A Consumer Lending Salvo,” New York Times, March 9, 2010.

Ben Werschkul, “Elizabeth Warren’s Mission,” New York Times, March 24, 2010.

Jodi Kantor, Business, “Behind Consumer Agency Idea, a Tireless Advocate,” New York Times, March 24, 2010.

Jodi Kantor, “Consumers’ Champion Wages Her Own Crusade,” New York Times, |March 25, 2010, p. 1.

Tim Dickinson, “Elizabeth Warren vs. Wall Street. She May Be the Only Person in Washington Who Stands Between Us and the next Meltdown…,” RollingStone.com, April 12, 2010.

Michael Scherer/Washington, “The New Sheriffs of Wall Street,” Time, May 13, 2010.

Joshua Green, “Elizabeth Warren,” Atlantic Monthly, November 2010.

Rebecca Johnson, “Elizabeth Warren: Held to Account,” Vogue.com, December 20, 2010.

Editorial, “New Top Consumer Cop Is Bankers’ Second-Worst Nightmare,” St. Louis Post Dispatch, July 19, 2011.

Jill Lawrence, “ ‘I Wasn’t Born at Harvard’: Elizabeth Warren Meets the Voters. Now Running for the U.S. Senate, The Consumer Advocate Conservatives Love to Hate Turns Out to Have A Deft Touch on the Stump,” The Atlantic, September 15, 2011.

Greg Sargent, “Game On: Elizabeth Warren Stands By Occupy Wall Street,” WashingtonPost.com, October 26, 2011.

Suzanna Andrews, “The Woman Who Knew Too Much,” VanityFair.com, November 2011.

Darla Shelden, “Oklahoma Debate Champion and Advocate for Middle Class Families Becomes Senate Hopeful,” CitySentinel.com (Oklahoma), December 14, 2011.

Kevin D. Williamson, “Occupy The Senate: Elizabeth Warren Meets the 99 Percent,” National Review, April 16, 2012.

Glen Johnson, “Elizabeth Warren Blasts Mitt Romney as She Introduces President Obama in Boston,” Boston.com, June 25, 2012.

Jeffrey Toobin, “The Professor; Elizabeth Warren’s Long Journey Into Politics,” NewYorker.com, September 17, 2012.

Noah Bierman, “Warren Releases Financial Report; Earned $700,000 in 2-year Period,” BostonGlobe.com, September 21, 2012.

Katie Glueck, “Sheila Bair: Warren Is ‘Whip-Smart’,” Politico.com, November 2, 2012.

Jonathan Martin, “Populist Left Makes Warren Its Hot Ticket,” New York Times, September 29, 2013.

Noam Scheiber, “Hilary’s Nightmare A Democratic Party That Realizes its Soul Lies With Elizabeth Warren Instead,” New Republic.com, November 10, 2013.

Gregory S. McNeal, “Is Affluenza Real? Ask Senator Elizabeth Warren And Other Experts,” Forbes.com, December 13, 2013.

“Elizabeth Warren’s Political Journey; 11 Photos,” USAToday.com, April 20, 2014.

David Moberg, “It’s the Inequality, Stupid. How to Frame the ‘Defining Challenge of Our Time’,” InThese Times.com, September 2014 September 29, 2014.

John Cassidy, “Elizabeth Warren Wins the Midterms,” NewYorker.com, October 29, 2014.

George Zornick, “Elizabeth Warren Insists She’s Not Running for President. These Activists Are Trying to Change Her Mind; But Would a Warren Campaign Help—or Hurt—the Causes She Cares Most About?,” TheNation.com, February 4, 2015.

Katrina Booker, “Be Afraid. Be Very Afraid. Why Elizabeth Warren Makes Wall Street Tremble,” Bloomberg Markets, June 2015.

Micheal Scherer, “How Elizabeth Warren’s Populist Fury is Remaking Democratic Politics,” Time, July 9, 2015.

Kathleen O’Brien | For Inside Jersey, “How Elizabeth Warren’s Rutgers Roots Forged Her Future VP Prospects,” NJ.com, June 25, 2016.

Isabelle Taft, “How a Decade in Texas Changed Elizabeth Warren,” TexasTribune .org, July 13, 2016.

Matt Egan, “Elizabeth Warren’s Epic Takedown of Wells Fargo CEO,” CNN.com, September 21, 2016.

Ahiza Garcia, “Elizabeth Warren Wants Wells Fargo Firings Investigated,” CNN.com, September 22, 2016.

Karen Veazey, “The Rise of Elizabeth Warren From Determined Little Girl to Powerful Senator,” SheKnows.com,

Feb 10, 2017.

Andy Kroll, “Why Is Elizabeth Warren So Hard to Love?,” BostonMagazine.com, April 2, 2017.

Nancy Coleman, “Pint-Sized Persistence: Elizabeth Warren Action Figure Fights the Patriarchy from Your Pocket,” CNN.com, June 9, 2017.

Graham Vyse, “How Elizabeth Warren Became the Soul of the Democratic Party,” NewRepublic.com, October 12, 2017.

Elizabeth Warren, OP-ED, “Companies Shouldn’t Be Accountable Only to Shareholders; My New Bill Would Require Corporations to Answer to Employees and Other Stakeholders as Well,” Wall Street Journal, August 14, 2018.

Charles P. Pierce, “Elizabeth Warren Put a Stake in the Ground. We Should Pay Close Attention. If Corporations Want to Be Treated like People Then They Should Be Punished like Them, Too.” Esquire.com, August 16, 2018.

Michael Kruse, “The Making of Elizabeth Warren. In 2004, She Was a Respected but Little-known Academic with an Obscure Specialty. Then Dr. Phil Called,” Politico.com, November 30, 2018.

Associated Press, “US Sen. Warren Releases 10 Years of Her Tax Returns Online,” CNBC.com, Aug 23, 2018.

Sabrina Tavernise, “How Elizabeth Warren Learned to Fight,” NYTimes.com, June 24, 2019.

Sharon Cohen, [Associated Press], “Elizabeth Warren’s Rise Started by Looking at the Bottom,” Yahoo.com, August 25, 2019.

“Elizabeth Warren,” PopularTimelines.com.

Ryan Grim, “Elizabeth Warren on Her Journey From Low-Information Voter,” TheIntercept.com, February 19, 2018.

Rebecca Traister, “Leader of the Persistence; Elizabeth Warren’s Full-Body Fight to Defeat Trump,” New York Magazine, July 2018.

Julia A. Seymour, “CNBC’s Jim Cramer Boosts Warren’s ‘Novel’ Business Regulations,” NewsBusters.org, August 16, 2018.

“Sen. Elizabeth Warren: Accountable Capitalism Act | Mad Money | CNBC,” YouTube .com, October 29, 2018.

Jack Bohrer,“ ‘It Is a Pleasure to Blog with You’: Elizabeth Warren’s Early Years Online. When a Bankruptcy Reform Bill That Contained Favorable Terms for the Credit Industry Was Moving Through Congress in Early 2005, Warren Logged on,” NBCnews.com, January 6, 2019.

Grant Bianco, “’Whip-Smart’ and ‘Well-liked’: Elizabeth Warren’s Penn Law Students Remember Their Professor,” The Daily Pennsylvanian, January 22, 2019.

Jonah Goldberg, “Everyone a Conscript,” National Review, February 7, 2019.

“A Fighter From Within,” The Nation, March 2019.

“Elizabeth Warren: The Republican Years,” Politico.com, April 2019.

Tim Fernholz, “Elizabeth Warren Has a Very Timely Grudge with Joe Biden,” Quartz/ QZ.com, April 30, 2019.

“‘I Have A Plan For That: Elizabeth Warren,” Time, May 20, 2019.

Annie Linskey | Washington Post via CNHI News Service, “Dow Breast Implant Case Spotlights Elizabeth Warren’s Work Helping Big Corporations Navigate Bankruptcies,” July 23, 2019.

Rebecca Traister, “Elizabeth Warren’s Classroom Strategy a Lifelong Teacher, She’s the Most Professorial Presidential Candidate Ever. But Does America Want to Be Taught?.” NYmag.com, August 6, 2019.

Stephanie Saul, “The Education of Elizabeth Warren,” New York Times, August 25, 2019.