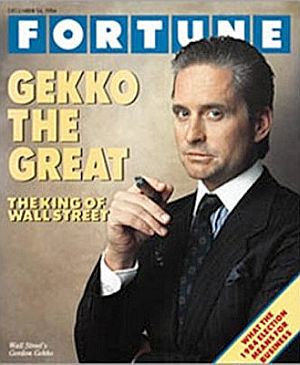

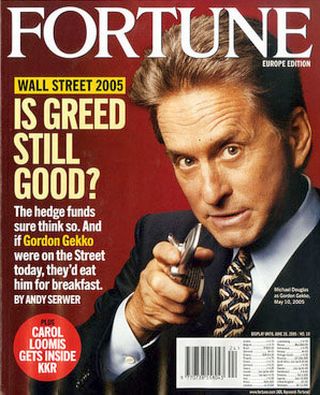

Fortune magazine used a Michael Douglas image to invoke Gordon Gekko, the ruthless fictional trader of 1987's film “Wall Street” for a June 2005 cover story.

Gekko is cast as the fictional archetypal hustler; the big-time trader/speculator/corpo- rate raider who made “greed is good” the signature catch phrase of the go-go 1980s.

In the Oliver Stone film, Gekko is played to a tee by actor Michael Douglas. Douglas, in fact, won the Best Actor Oscar for his portrayal of Gekko, the unscrupulous corporate raider who stops at nothing to get what he wants.

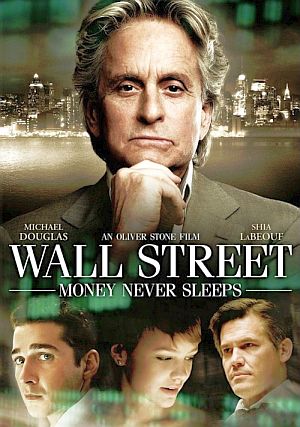

Nearly twenty years later, the fictional Gekko played by Douglas had left enough of an impression that he was used on the cover of the June 2005 Fortune magazine at right to spotlight a story on the new greed of Wall Street. And more recently, by 2008-2009, during the latest financial crisis, with greed still doing its thing big time, references to Gekko and his quips were once again being heard. And by May 2010, a sequel to the 1987 film, Wall Street 2: Money Never Sleeps, was released, featuring a somewhat reformed Gordon Gekko, having served his prison term, though angling for revenge. In the piece that follows, while both films are covered, the first film is more the focus, exploring its history and audience reaction, and why in some cases its characters and rapacious behavior were admired and emulated and its central message unheeded.

The 1980s

Producer Oliver Stone set his Wall Street film in the mid-1980s, around the time several insider trading scandals and prosecutions were in the news. The film also portrayed the high-flying life styles of New York traders rolling in their Wall Street largesse during that era. In addition to capturing the essence of the Gordon Gekko character and his “take-no-prisoners” school of capitalism, the film also featured the “wanna-be-like Gordon” strivings of young trader, Bud Fox, played by Charlie Sheen. Fox soon becomes Gekko’s protégé and partner in crime, living in the fast lane for a time, with an Upper East Side condo, beautiful live-in companion Darien (Daryl Hannah), while making bundles of money — all courtesy of Gordon Gekko. But young Bud eventually sees through his hot-shot mentor and the damages his wheeling and dealing can cause — including one plan to buy, eviscerate, and sell off as parts, the airplane company his working-class father, Carl Fox, is employed by ( Sheen’s fictional dad in this case is also his real one, Martin Sheen, playing a union leader who tries to warn his son that Gekko is using him). Bud gets caught by the Feds while doing some insider handiwork for Gekko, but later turns government informant, wearing a wire, to help send his former boss to jail. The film ends with Bud heading to court, presumably to seal the case against Gekko.

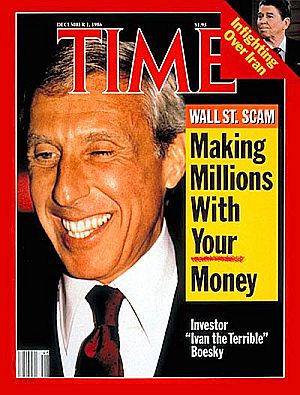

One of the more memorable and much quoted moments of the film comes when Gekko gives a speech at a shareholders’ meeting of Teldar Paper, a company he is planning to take over. This is the famous “greed is good” speech as Gekko defends his planned takeover, pointing to the bloated and wasteful ways of post-War corporate America, using Teldar’s management as Exhibit A, and claiming himself the company’s saviour — a “liberator” of value (see sidebar below).Parts of this fictional speech are reported to have come from actual speeches that real-world Wall Streeters had given — namely by corporate raider Carl Icahn and financial wheeler-dealer Ivan Boesky. Ichan had railed against corporate management who owned little of their own companies, had too many high-level executives, and were otherwise inefficient. And Ivan Boesky is credited with inspiring the “greed is good” line, paraphrased from a May 18, 1986 commencement address he gave at the University of California, Berkeley, School of Business Administration. Boesky said then: “Greed is all right, by the way. I want you to know that. I think greed is healthy. You can be greedy and still feel good about yourself.” Boesky was later one of those convicted of insider-trading.

|

“Greed is Good” In the film, Gordon Gekko is given the opportunity to address the Teldar Company’s shareholders assembled in a large meeting hall. This is the speech that ends with his famous “greed is good” remarks. During the meeting, Gekko takes to the floor, microphone in hand, thanking the company chairman, Mr. Cromwell, for the opportunity to speak — adding, “after all, I am Teldar’s single largest shareholder.” Gekko then proceeds to walk down the center aisle of the meeting, with shareholders all around him, offering his views:  Gordon Gekko adressing Teldar board from floor of shareholders meeting, "Wall Street," the movie, 1987. GEKKO: All together, these men sitting up here [pointing to Teldar management] own less than 3 percent of the company. And where does Mr. Cromwell put his million-dollar salary? Not in Teldar stock; he owns less than 1 percent. GEKKO: You own the company. That’s right — you, the stockholder. And you are all being royally screwed over by these, these bureaucrats, with their steak lunches, their hunting and fishing trips, their corporate jets and golden parachutes. CROMWELL: This is an outrage! You’re out of line, Gekko!  Gordon Gekko, at Teldar, giving his "greed-is-good" speech. GEKKO: The new law of evolution in corporate America seems to be survival of the unfittest. Well, in my book you either do it right or you get eliminated. In the last seven deals that I’ve been involved with, there were 2.5 million stockholders who have made a pretax profit of 12 billion dollars. Thank you. I am not a destroyer of companies. I am a liberator of them! GEKKO: The point is, ladies and gentleman, that greed — for lack of a better word — is good. GEKKO: Greed is right. Greed works. Greed clarifies, cuts through, and captures the essence of the evolutionary spirit. Greed, in all of its forms — greed for life, for money, for love, knowledge — has marked the upward surge of mankind. And greed — you mark my words — will not only save Teldar Paper, but that other malfunctioning corporation called the USA. GEKKO: Thank you very much. |

Not A Blockbuster

Gordon Gekko and Bud Fox in Gekko’s office looking out on a New York city skyline. Click for promotional photo.

Bud Fox at his trading desk where he sets out to make some quick bucks doing deals for Gordon Gekko.

Holbrook represents, in Oliver Stone’s words, “the positive forces in the market.” He is also part Oliver Stone’s father, who was in real life a stockbroker for 40 years and believed Wall Street “could do a lot of good,” according to Stone. In the film, Holbrook, represents the old patient school of investing, and he tries to teach Bud Fox the ethics of the business. But Fox, at first, is more enamored of the deal, deal maker Gekko, and the quick, big money.

Gordon Gekko: "Lunch is for wimps."

Gekko, in fact, is quick with the quips that sum up the tough-guy trader ethos: “Lunch is for wimps,” he says at one point. And he has a bunch of others as well — “Money never sleeps”; “What’s worth doing is worth doing for money”; “If you need a friend, get a dog.” “If you’re not inside your outside.” Here’s Gekko boasting to Bud about how he made some of his early money: “You see that building? I bought that building ten years ago. My first real estate deal. Sold it two years later, made an $800,000 profit. It was better than sex. At the time I thought that was all the money in the world. Now it’s a day’s pay.” Gekko also tells Fox during the film:

Bud Fox getting a big account check from Gordon Gekko.

“…We make the rules, pal. The news, war, peace, famine, upheaval, the price per paper clip. We pick that rabbit out of the hat while everybody sits out there wondering how the hell we did it. Now you’re not naive enough to think we’re living in a democracy, are you Buddy? It’s the free market. And you’re a part of it. You’ve got that killer instinct. Stick around pal, I’ve still got a lot to teach you.”

But perhaps one of the best lines in the film goes to Carl Fox, Martin Sheen’s character, trying to counsel his son on the better course: “…Money’s only something you need in case you don’t die tomorrow…” And here’s another from Bud Fox’s stock-trading co-worker, Marv: “We’re all just one trade away from humility.”

“What’s intriguing about Wall Street…,” wrote film critic Robert Ebert in his 1987 review, “is that the movie’s real target isn’t Wall Street criminals who break the law. Stone’s target is the value system that places profits and wealth and the Deal above any other consideration. His film is an attack on an atmosphere of financial competitiveness so ferocious that ethics are simply irrelevant, and the laws are sort of like the referee in pro wrestling — part of the show.”

At a dinner party gathering with Gekko, Darien (Daryl Hannah) and Bud’s father, Carl Fox (Martin Sheen, far right), discussing the Bluestar Airlines deal.

Lessons Learned?

Oliver Stone’s intention with his film in 1987 was to show Wall Street’s excesses and its callousness, and with Gekko, a repulsive character, whose quips and creed were put on display as bad example. Yet if the film’s message was meant to discourage Gekko’s brand of behavior, it may have fallen short. Some critics, in fact, felt the film was a little too good at glorifying the values it set out to deplore. The film’s screenwriter, Stanley Weiser, actors Charlie Sheen and Michael Douglas, and Oliver Stone would all acknowledge this to some degree, noting that people would tell them they admired the Gekko and Fox characters in their hard-charging Wall Street styles and money-making schemes. Some even said they went into business or became stockbrokers because of what they saw in the film. Douglas told a reporter that the continued resonance of Gekko in this popular vein was “probably been the biggest surprise of my career; that people say that this seductive villain has motivated [them] to go into this business.” Oliver Stone has said much the same thing. “I can’t tell you how many young people who have come up to me and said ‘I went to Wall Street because of that movie’,” he said in a 2009 conversation with New York Times reporter Tim Arango. “…So I think the movie was misunderstood by some,” Stone explains, “because it was about a horrible thing going on; about how people would worship money at all costs.” Stone, who today also teaches college students in a film course, has told them, “Wall Street can be the engine of capitalism,” to create opportunity, but he adds that Wall Street has increasingly not done that “because there’s more money in speculation.” In more recent years, closer to the 2007-2009 economic crisis, references to Gordon Gekko have come around a bit more as Stone intended. Now Gekko’s name appears to be finding some new instructional currency. “Today we are still clean- ing up the mess of the 21st-century children of Gor- don Gekko.”

– Kevin Rudd, Australian P.M. In an October 8th, 2008 speech by Australian Prime Minister Kevin Rudd, titled “The Children of Gordon Gekko,” for example, Rudd takes aim at the financial crisis of 2007-2008. “It is perhaps time now to admit that we did not learn the full lessons of the greed-is-good ideology,” he said. “And today we are still cleaning up the mess of the 21st-century children of Gordon Gekko.” Similarly, in Italy, Cardinal Tarcisio Bertone, a Vatican official, cited Gekko’s greed is good slogan in remarks he made in July 2009 to Italian Senators in Rome. Cardinal Bertone said the free market had been replaced by a greed market, blaming such a mentality for the 2007-2008 financial crisis. And in September 2009, former Harvard Business School graduate, Philip Delves Broughton, now a writer for the London Evening Standard, observed:

Gordon Gekko telling the Teldar board and shareholders in “Wall Street” 1987 how his version of “greed-is-good” efficiency will work.

…Gekko’s Greed is Good speech is still shown to MBA students at business schools. It is intended as a morality lesson, but ends up feeling more like a pep talk. At my old business school, Harvard, Gekko’s speech electrified a snoozy morning class on leadership. By the time Gekko was done berating the board of Teldar Paper, the entire class was grinning and alert.

For most MBA students that speech is less a parody than a guiding phil- osophy. Over the past year, as Wall Street froze hiring and many MBA students struggled to find work, a wave of ethical re-evaluation swept business school campuses. A group of Harvard Business School students even came up with an MBA oath, vowing to be responsible, law-abiding, civic-minded business people.

It was not the kind of thing anyone bothered with when the economy was roaring along and students could still fantasize about gliding from business school into a world of Gekko-ish riches.

Still, among bankers in the late 2000s, there was some one-upping of the Gekko creed with a new twist. In November 2009, Barclays CEO John Varley stood at a church lectern in London telling his audience that “profit is not satanic.” The 53-year-old head of Britain’s second-biggest bank was there in part to defend high pay to bankers. “Profit is not satanic.”

-John Varley, Barclays Bank Rewarding high-performing bankers with more pay, he explained, didn’t conflict with Christian values. Bankers in Britain had taken to the churches in response to critics who charged them with creating great disparities in wealth and inequality. A few weeks earlier, Goldman Sachs International adviser, Brian Griffiths, giving a talk at London’s St. Paul’s Cathedral had stated: “The injunction of Jesus to love others as ourselves is an endorsement of self-interest…. We have to tolerate the inequality as a way to achieving greater prosperity and opportunity for all.” Gordon Gekko, no doubt, would be smiling over that one, but others might find it downright un-Christian.

Meanwhile, 20 years after the making of 1987’s Wall Street, Gordon Gekko was set to make a renewed appearance with a sequel of the film – this one set in the financial world of the late 2000s.

20th anniversary, 2007 DVD edition of 1987's “Wall Street” film, featuring Gordon Gekko. Click for DVD.

The Sequel

The new Wall Street film had been rumored for years, and in October 2008, it was reported that 20th Century Fox began fast-tracking a follow-up production. The sequel, Wall Street: Money Never Sleeps, was released in September 2010.

In this film, Gordon Gekko has been released from prison, having served a 20-year sentence for his earlier nefarious deeds. Now, however, he faces a much different Wall Street than the one he left.

“Gekko would no longer exist in this new Wall Street,” said Oliver Stone in one early interview for the new film. “The big players now are major banks and hedge funds … the money’s too big.” In the new film, explained Stone, “greed is now legal.”

The sequel would draw inspiration from the 2008-2010 credit crunch and money-making schemes of hedge fund swindlers. There would also be more emphasis on the role of investment banks and less on traditional stock trading. The field of play would be more global as well, ranging from Wall Street to Abu Dabai, the Far East, and other locations, but also including New York’s Federal Reserve Bank.

New York Times business columnist, Gretchen Morgenson, learning of the forthcoming sequel in September 2009, and musing on the prospects for a new storyline for the fresh-from-prison Gordon Gekko, offered the following possibilities:

…Gordon Gekko is delighted to see that his views on greed have spawned a growth industry. No longer must he endure criticism when he preaches that greed is good; his concept has in fact gained acceptance at the highest reaches of commerce. Even better, the United States government has taken the view that on the rare occasions when greed goes bad, the taxpayer will be there to pick up the tab.

Gordon Gekko at his command post in “Wall Street,” 1987.

To be sure, Mr. Gekko is sorry to have missed out on the billions he could have made during the subprime mortgage boom. But he recognizes that his exit from prison is perfectly timed in another way. In the aftermath of the credit bubble, 17,000-square-foot mansions in Greenwich, Conn., go begging, Gulfstream jets can be bought on the cheap and prestigious golf clubs no longer have years-long waiting lists.

Because he went to jail for securities fraud and probably agreed to sanctions in the case, Mr. Gekko is barred from working for a financial firm or becoming a registered investment adviser. Still there are other possibilities: starting a hedge fund that accepts only a handful of wealthy and sophisticated clients, for example. Based in the Cayman Islands, the Gekko Insider Insights Fund will almost certainly specialize in high-frequency trading, the investment strategy du jour. Just as certain: investors, eager to hire a manager of such notoriety and business acumen, will throw billions Mr. Gekko’s way.

Gordon Gekko and Bud Fox making plans for the trading day in "Wall Street," 1987. Click for promotional photo.

However, in the sequel, Gordon Gekko is estranged from his daughter, Winnie (played by Carey Mulligan), although he hopes to repair this relationship. And in time, circumstances would present themselves for Gekko to forge an alliance with his daughter’s fiancé, Jacob “Jake” Moore (played by Shia LaBeouf), an idealistic stock broker who has already done well for himself. Although Jake comes to view Gordon as a father figure, he soon learns that Gekko is a master manipulator who will stop at nothing to achieve his goals. Gekko works his future son-in-law to help take down a Wall Street enemy (one who had played a role in sending Gekko to prison) and begin rebuilding his former empire. Along the way in this film, there is ample financial intrigue and manipulative wrongdoing, as Jake’s firm and his mentor there get burned. There are also revelations of Wall Street’s shaky underpinnings, personal tragedy, and more. Gekko, meanwhile, finds the means to get back “in the game” again, big time.

By correctly predicting the coming financial collapse, Gekko — now set up in London, England — sells the market short and turns $100 million that he has “borrowed”/stolen from his daughter’s Swiss account trust fund (which he had squirreled away for her) into an incredible sum of $1 billion or more. Now a billionaire again, and having paid back the $100 million to his daughter and also invested in his son-in-law’s alternative energy venture, the timeline flashes forward a year or two, as a happy family scene closes the film, with Gekko now reconciled with his daughter, visiting her, Jake, and their young child.At the box office, Money Never Sleeps did well ($134 million in ticket sales and $15 million on DVD), but critics offered mixed reviews, though with praise for the Douglas portrayal of Gekko. However, some reviewers felt that Money Never Sleeps lacked the punch of the first Wall Street film. Roger Ebert, of the Chicago Sun-Times, found the film to be “an entertaining story about ambition, romance and predatory trading practices, but it seems more fascinated than angry.” It had good production values, Ebert observed, but it lacked a certain quality of viewer outrage in message. “I wish it had been angrier,” he wrote. “I wish it had been outraged.”

Peter Bradshaw of The Guardian noted that “no one is ever shown enduring the actual misery of losing money” in the film. And a Slate.com reviewer added, “we never see a homeowner evicted from an overleveraged house,” but said the film “feels urgent and strangely necessary.”

One YouTube writer, Randal Graves, offering a comment in 2014 on the movie’s trailer, noted: “This film was good… but not as good as it would’ve been if Bud Fox and Gordon Gekko teamed up again and bankrupted some hedge fund tycoons.” (Bud Fox only makes a brief appearance in the film).

Stephen Lambrechts of IGN Australia concluded the film is not “quite the incendiary attack that it could have been, but it still has plenty to say…” And Boxoffice Magazine’s Pete Hammond called it a “…powerhouse of a movie that shines a light on the financial machinations.” As for lessons learned and ethical messages, those were mostly left to whatever film-goers might take away on their own accounts.Still, the real world events of the financial melt down of 2007-2008 and its aftermath — ably reported in a number of probing book-length accounts to date — offer standing lessons that provide the scarier truths.

Additional business-related stories at this website can be found at the “Business & Society” category page, and include, for example: “Flash Boy Lewis” (covering Wall Street’s “flash trading” and Michael Lewis’s publishing history); “Celebrity Buffett” (Warren Buffett investing history and his rise to mainstream notice); “Empire Newhouse”( history of the Newhouse publishing empire through 2012 and Reddit.com); and “Murdoch’s NY Deals” (covering the rise and 1970s American expansion of the Rupert Murdoch media empire).

Thanks for visiting – and if you like what you find here, please make a donation to help support the research and writing at this website. Thank you. – Jack Doyle

|

Please Support Thank You |

_______________________________________

Date Posted: 4 February 2010

Last Update: 23 August 2022

Comments to: jackdoyle47@gmail.com

Article Citation:

Jack Doyle, “Wall Street’s Gekko, 1980s-2010,”

PopHistoryDig.com, February 4, 2010.

_______________________________________

Sources, Links & Additional Information

Geraldine Fabrikant, “Wall Street Reviews ‘Wall Street’,” New York Times, December 10, 1987, p. D-1.

Sheila Benson, Movie Reviews, “‘Wall Street’ Lays an Egg,” Los Angeles Times, December 11, 1987.

Rita Kempley, Movie Review, “Preachy, Punchy ‘Wall Street’,” Washington Post, December 11, 1987, p. C-1.

Roger Ebert, “Wall Street: Film Review,” Chicago Sun Times, December 11, 1987.

Vincent Canby, Movie Review, “Wall Street,” New York Times, December 11, 1987.

“Wall Street Movie Speech (1987),” American Rhetoric.com.

“Wall Street” (1987 film), Wikipedia. org.

Michael Cieply, Connie Benesch, “‘Wall Street’ Makers Look for Upturn; Financial Melodrama Doing Well in Big Cities, but Not Elsewhere,” Los Angeles Times, December 19, 1987.

John Gross, “The New Greed Takes Center Stage,” New York Times, January 3, 1988, p. 21.

Bettijane Levine, “Fashion 88: Men Are Bullish on Power Styles Seen in ‘Wall Street’,” Los Angeles Times, January 8, 1988.

James K. Glassman, “The Monster That’s Eating Wall Street; Voodoo Credit, Buy-Out Mania Are Killing Value and Values,” Washington Post, January 10, 1988, p.C-1.

Otto Friedrich, Richard Behar, Richard Hornik & William McWhirter, “Freed From Greed?,” Time, Monday, January 1, 1990.

Steven Pearlstein, “Icon of an Era; Drexel Came to Epitomize Wall Street’s 1980s Excess,” Washington Post, February 14, 1990, p.1.

“Predator’s Fall: Drexel Burnham Lambert,” Time (cover story), Monday, February 26, 1990.

David A. Kaplan, “Wall Street: A Greed Apart; The Final Word (So Far) On ’80s Insider Trading,” Newsweek, October 14, 1991.

Sylvia Nasar, Ideas & Trends, “Adam Smith Was No Gordon Gekko,”New York Times, January 23, 1994, p. 46.

IGN Staff, “Wall Street: Greed is Good. This Movie is Better,” IGN.com, November 10, 2000.

Daniel Akst, On the Contrary; “Was Gordon Gekko Right About Greed?,” New York Times, August 4, 2002, p.34.

Michael Noer and Dan Ackman, “Gordon Gekko #14: The Forbes Fictional Fifteen,” Forbes.com, September13, 2002.

Stefan Stern, “Gordon Gekko May Be Back In Fashion, “Book Review of Hardball,” Financial Times, Thursday, October 7, 2004.

Andrew Ross Sorkin, Dealbook, “How to Show That You’re No Gordon Gekko,” New York Times, March 25, 2007.

Simon Goodley, “Brace Yourself, Gekko is Back,” The Telegraph (U.K.), August 28, 2007

Telis Demos, “Oliver Stone: Life after ‘Wall Street’,” Fortune, September 21, 2007.

Telis Demos, “Where’s Gekko? ‘Wall Street’ Turns 20,” Fortune, September 21, 2007:

Alex Cohen, “When Greed Became Good On ‘Wall Street’,” National Public Radio, NPR.Org, October 16, 2008.

Frank Ahrens, “The Return of Gordon Gekko?,” WashingtonPost.com, October 14, 2008.

Tatiana Siege, “Fox, Loeb up for ‘Wall Street’ Sequel; Michael Douglas Could Reprise Gekko Role,” Variety.com, October 13, 2008.

“Gordon Gekko,” Wikipedia.org.

Stanley Weiser, “Repeat After Me: Greed Is Not Good,” Co-writer of ‘Wall Street’ Worries That the Movie’s Message Is Misunderstood, Especially Now, Los Angeles Times, October 5, 2008.

Kevin Rudd, “The Children of Gordon Gekko,” The Australian, October 6, 2008 (edited extract from speech by Australian Prime Minister Kevin Rudd).

Alastair Jamieson, “Gordon Gekko to Return in Sequel as Film-Makers Trade on Credit Crunch,” The Telegraph (U.K.), January 19, 2009.

Owen Gleiberman, “Wall Street: What it Still Has to Tell Us,” Entertainment Weekly, March 28, 2009.

Flavia Krause-Jackson, “Vatican Slams ‘Greed Is Good’ Wall Street Mantra,” Bloomberg.com, July 28, 2009.

Tim Arango, “Greed Is Bad, Gekko. So Is a Meltdown,” New York Times, September 7, 2009.

Zach Wise & Timothy Arango, Video, “A Conversation With Oliver Stone,” New York Times, September 8, 2009.

Gretchen Morgenson, Considered, “Fast-Forwarding Gordon Gekko,” New York Times, September 13, 2009.

Philip Delves Broughton, “Wall Street 2: Gordon Gekko is Back,” London Evening Standard, September 14, 2009.

Bryan Burrough, “The Return of Gordon Gekko,” Vanity Fair, February 2010.

“Yearly Box Office – 1987 Domestic Grosses,” BoxOfficeMojo.com.

“Wall Street: Money Never Sleeps,” Wiki-pedia.org.

“Wall Street 2: Money Never Sleeps Trailer,” YouTube.com, posted by Jumpoff, Sep-tember 25, 2010.

Dana Stevens, “Gekko Never Sleeps: Michael Douglas Returns in Wall Street 2,” Slate.com, September 23, 2010.

Roger Ebert, “Wall Street: Money Never Sleeps,” Chicago Sun-Times (Sun-Times Media Group), September 23, 2010.

Stephen Lambrechts, “Wall Street: Money Never Sleeps AU Review,” IGN News Corporation, September 7, 2010.

____________________