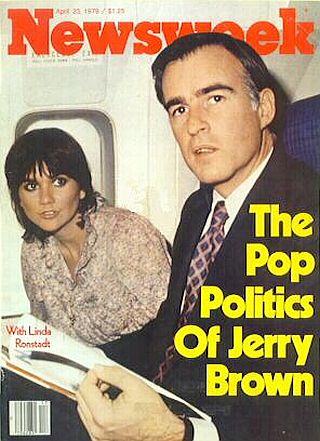

In April 1979, Newsweek magazine found the story of then California Gov. Jerry Brown and rock star Linda Ronstadt intriguing enough to make it a cover story.

The friendship between Linda Ronstadt and Jerry Brown grew gradually; they had some compatible interests and liked each other’s company. They enjoyed ethnic food, long walks along the California seaside, Japanese movies, and country music. Both were also Catholic.

By 1975, however, Brown and Ronstadt became high-profile celebrities in their respective realms – he in politics, by then California’s governor, and she, rising to the top of the music charts with her Heart Like a Wheel album. There is a lot more to their respective careers, both before and after 1975, explored later. Yet through their rising fame, and through most of the 1970s – including the glare of Brown’s presidential bids in 1976 and 1980 – they continued to see each other, with speculation at one point, mostly in the press, of a possible marriage between the two. That, however, in the words of an earlier Ronstadt/Stone Poneys song, “Different Drum,” would not likely occur, as the song’s lyrics suggest: “You and I travel to the beat of a different drum / Oh, can’t you tell by the way I run / Ev’ry time you make eyes at me…” Still, there was an interesting decade of activity between this rock star and politician, made more interesting by the swirl of music and politics of those times. What follows here is a look back at some of that history.

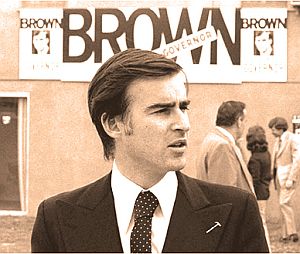

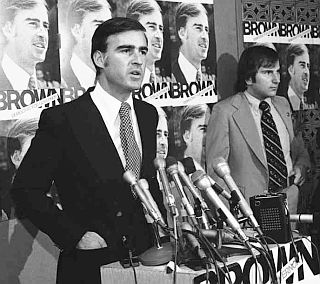

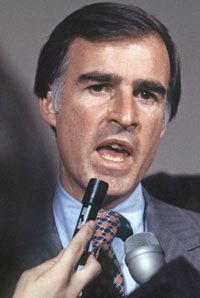

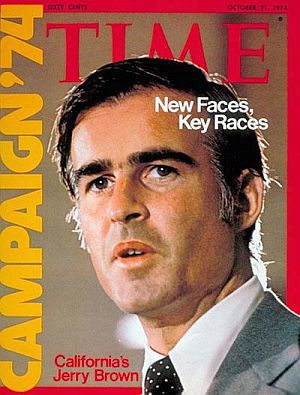

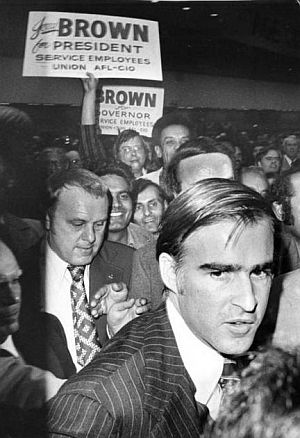

Jerry Brown, running for Governor of California, 1974.

Jerry Brown was born in San Francisco in 1938. His father, Edmund Gerald “Pat” Brown, was then District Attorney of San Francisco and later Governor of California for two terms (1959-1967). Young Jerry grew up in San Francisco and graduated from St. Ignatius Catholic High School. In 1955, after a year at Santa Clara University, he entered a Jesuit seminary, intent on becoming a Catholic priest, but left after three years. He then enrolled at the University of California, Berkeley in 1960, graduating a year later with a degree in Latin and Greek. A law degree from Yale followed in 1964. After law school, Brown returned to California and clerked for California Supreme Court Justice Mathew Tobriner. He then went into private practice in Los Angeles. In 1968, he left his L.A. law practice briefly to join U.S. Senator Gene McCarthy’s presidential campaign. Back in California in 1969, Brown ran for and won his first elective office, the newly created Los Angeles Community College Board of Trustees.

1974: Jerry Brown during his campaign to become governor of California.

In 1974, he ran for, and was elected governor of California at age 36, the youngest to do so in the state’s history. Brown followed Ronald Reagan in the Governor’s office, who previously held the post for two terms, 1967-1975.

On taking office, Brown garnered some headlines when he canceled the inaugural ball and refused to live in the $1.3 million governor’s mansion that Ronald Reagan had built. He also sold the governor’s limo and wouldn’t use the jet plane. He lived in an apartment, walked to work, and had his chauffeur drive him around in his 1974 Plymouth.

November 1974: California Governor-elect Jerry Brown meeting with outgoing Governor Ronald Reagan.

Once in office, Brown pushed a landmark farm labor law and new environmental initiatives. The farm labor measure won him particular kudos, as agreement on that front — while retaining labor’s right to strike — had eluded other politicians for more than 40 years. He also made some notable appointments, including Sim Van der Ryn as State Architect, and environmentalist Stewart Brand as Special Advisor, also adding minorities and women to major government posts. He significantly boosted funding for the California Arts Council.

In 1975, Brown helped repeal a prized oil-industry tax break, the “depletion allowance,” and later in his term sponsored the “first-ever tax incentive for rooftop solar.” Brown also strongly opposed the death penalty and later in his term vetoed it as Governor, although the legislature overrode his veto.

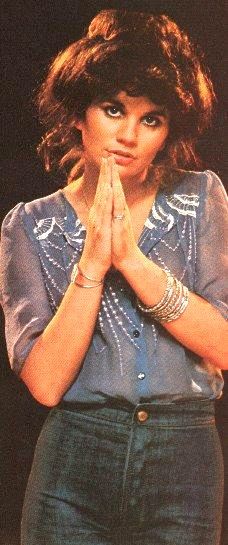

Linda Ronstadt

March 1968: Linda Ronstadt on her first solo album 'Hand Sown ...Home Grown', Topanga, California. Photo / Ed Caraeff

Music Player

“Different Drum”- Ronstadt/Stone Poneys

At age 18 in 1964, after meeting guitarist Bob Kimmel while attending University of Arizona briefly, the pair left for Los Angeles, joining guitarist and singer/songwriter Kenny Edwards to form the Stone Poneys. After three years the group broke up, but scored a Top 20 hit in 1967-68 with the Ronstadt-led “Different Drum.”

Following her stint with the Stone Poneys, Ronstadt then began a solo career, struggling for about five years, playing with various transient and backup musicians. Owing in part to her timid nature, she had some performance and self-confidence troubles in the studio and on stage. Along the way, there were also difficult romantic entanglements and some cocaine use, a period of her life she sometimes refers to as the “bleak years.” But it wasn’t all bad.

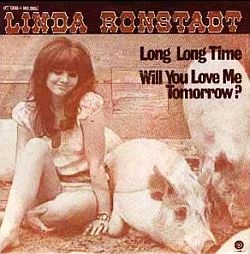

In March 1970, her second solo album, Silk Purse, was released, but it did not fare well on the music charts. However, one of its singles did – “Long Long Time,” rising in late-summer 1970 to No. 25 on the Billboard pop chart. The song proved to be an opening for Ronstadt, highlighting her voice and talent.Music Player

“Long Long Time”- Linda Ronstadt

“Long Long Time” earned her a Grammy Award nomination in early 1971, although Dionne Warwick took the prize that year for best contemporary female vocalist.

One of Ronstadt’s backing bands in her early solo period featured musicians Don Henley, Glenn Frey, Bernie Leadon, and Randy Meisner, who went on to form the Eagles, one of the most successful American rock bands of the 1970s. They toured with her for a short period in 1971 and played on Linda Ronstadt, her self-titled third album. In those years she was beginning to define a new genre of music, sometimes called country rock.

Linda Ronstadt with Peter Asher in a later 1970s photo. Asher helped advance her career.

With Asher, she made two albums – the first, Don’t Cry Now, came out in 1973 which would sell 300,000 copies. Among its songs was “Desperado,” an Eagles song she would notably perform in concert. The album also included her first country hit, “Silver Threads and Golden Needles,” which broke into the Top 20.

Capitol Records, meanwhile, perhaps suspecting there might be more upside business opportunity in Ms. Ronstadt’s voice than they previously believed, began digging up her older tunes and issuing them as compilation albums, one of which appeared in early 1974 under the title, Different Drum.

But the second album she made with Peter Asher, Heart Like a Wheel, became her big breakthrough album. Asher would later tell Time magazine: “Linda is brilliant musically. Her voice is qualitatively exceptional…”.

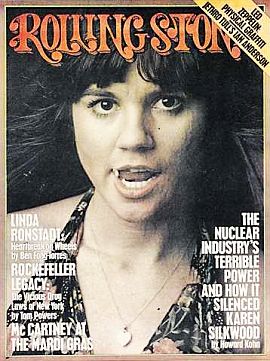

March 27, 1975: Linda Ronstadt on the cover of "Rolling Stone" magazine.

Music Player

“You’re No Good”- Linda Ronstadt

“You’re No Good” was also a hit for Ronstadt in Australia (#15), the Netherlands (#17), and New Zealand (#24). The B-side, “I Can’t Help It If I’m Still in Love With You,” a Hank Williams cover, hit No. 2 on the C & W chart. That song would also win her a Grammy that year for Best Female Country Vocal Performance. Another song from Heart Like A Wheel – the follow-up single, “When Will I Be Loved” – a 1960 Everly Brothers hit, was also a big Ronstadt hit. In May 1975, her uptempo version of this song hit No. 2 on the pop chart and No. 1 on the country chart. A review of the song at AllMusic.com by Denise Sullivan notes, in part:

“…There was no disputing her vocal prowess, but Ronstadt’s choice in repertoire was equally important to her success, as she continually picked heartbreakers and tearjerkers like ‘When Will I Be Loved.’ Oddly, there wasn’t a shred of inauthenticity in the sung sentiments, even though Ronstadt was considered to be a hugely popular singer and sex symbol with an active personal life. Yet, she gave the song its definitive reading, even more so than the Everly Brothers…”

Linda Ronstadt, 1970s.

In September 1975, another Ronstadt album came out – Prisoner In Disguise – which quickly climbed into the top five on the Billboard chart and sold over a million copies. Asylum Records also issued a single from that album with a Ronstadt version of “Heat Wave,” a 1963 Motown/Martha & The Vandellas tune on the A-side, and Neil Young’s “Love Is a Rose” on the B-side. “Heat Wave” proceeded to crack the top five on Billboard’s pop chart, while “Love Is A Rose” did the same on Billboard’s country chart. With her new-found success that fall, she also bought a place of her own – reported at the time to be a $325,000 beach house in Malibu. Ronstadt by this time was also filling up her rock concert outings, as she did at the Center for the Performing Arts, San Jose, California on September 22, 1975. In 1976, a European tour — her first outside the U.S. — extended her popularity. Back in the States, meanwhile, her friend, Jerry Brown was about to make some waves of his own.

“Brown-for-Prez” (Pt.1)

In March 1976, Jerry Brown began his first run at the Democratic Party nomination for President of the United States. However, the primary season had already begun and several other candidates, including Georgia Governor Jimmy Carter, had been campaigning for a year.

The Democratic primaries that year had become more numerous and more important in the nominating process than they were previously, and Carter, for one, set out to run in all of them. He surprised political pundits by finishing second in the Iowa caucuses (“uncommitted” finished first). Rep. Morris Udall, a front-runner in early polls, came in fifth behind former Senator Fred R. Harris. Carter went on to win in New Hampshire, North Carolina (defeating George Wallace), Pennsylvania (defeating Senator Henry “Scoop” Jackson ) and Wisconsin (beating Mo Udall).

However, some Northern and Western liberal Democrats viewed Carter as too conservative, and sought alternative candidates to block him from getting the nomination. Jerry Brown and Senator Frank Church of Idaho were seen by some as possible alternatives to Carter, or at least to help slow him down.

Jerry-Brown-for-Prez button, 1976.

In the New Jersey and Rhode Island primaries, Brown supported uncommitted slates of delegates which “won” in those contests. In Louisiana, Governor Edwin Edwards backed Brown, helping him win a majority of that state’s convention delegates, besting southerners Carter and George Wallace.

July 15, 1976: Jerry Brown and Jimmy Carter at the Democratic National Convention in New York City after Carter won the party's nomination. AP Photo

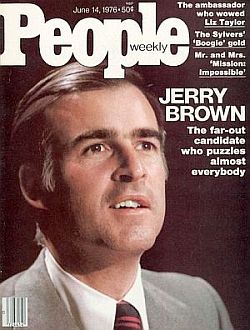

Still, Brown’s bid for the Democratic nomination was seen as too late by party insiders and quixotic by others. People magazine ran a June 14, 1976 cover story on Brown with the tagline, “The far-out candidate who puzzles almost everybody.”

In campaigning, Brown spoke of “an era of limits” – not typically a Democratic sentiment – while critics found his term as California’s Governor unimpressive. Yet his late-coming primary victories had been a demonstration of his voter appeal.

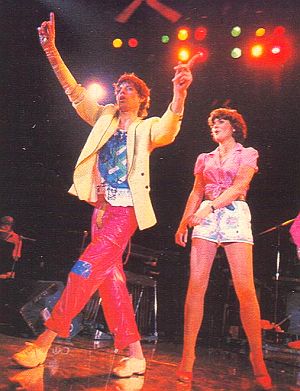

Linda Ronstadt with Eagles & Gov. Jerry Brown. Photo, Chuck Pullin. |

May 14, 1976: From left, Dan Fogelberg, Linda Ronstadt, Governor Jerry Brown and Joe Walsh on stage at Maryland concert . Photo, Richard E. Aaron / Redferns |

Despite Jerry Brown’s impressive showing in a short amount of time, he was unable to stall Carter’s momentum. At the 1976 Democratic National Convention in New York city, Carter was nominated on the first ballot. Brown finished third with roughly 300 delegate votes behind Congressman Morris Udall of Arizona.

Jerry Brown, however, had his supporters during his brief presidential bid – not least of whom was a contingent of rock music stars, including Linda Ronstadt. Brown had Ronstadt’s help and that of others from the rock music business. Ronee Blakley, Helen Reddy, Jackson Browne, Joni Mitchell and Ronstadt all performed at various times for Brown at fund-raisers and rallies.

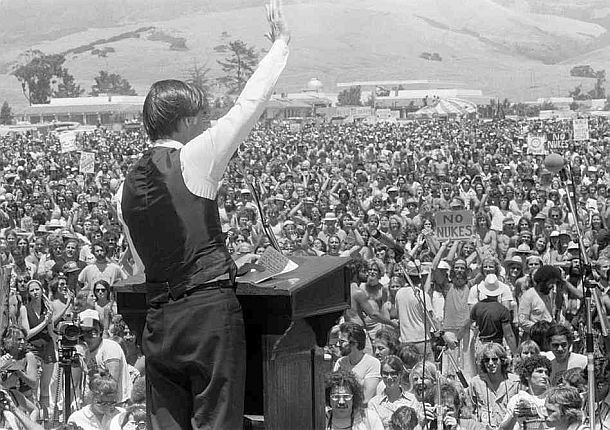

At one “Brown For President” benefit concert event held at the Capital Center in Maryland in mid-May 1976, Brown joined Ronstadt, The Eagles and other performers on stage briefly, waving to the audience. Although Jerry Brown’s run for the presidential nomination ended, and he went back to being Governor of California, there would be more Jerry Brown presidential politics in the future.

Linda Ronstadt, meanwhile, in a December 1976 interview with Creem magazine, appeared to be having some second thoughts about mixing her concert gigs with political advocacy:

“I’ve retired from politics…. For a while, I thought it might do some good working for someone I believe in, like Jerry Brown, but now I’m only going to do benefits for concrete causes in the community that I live. Right now that happens to be Los Angeles.”

“I just got tired of mixing up the message. I mean, if kids are there to listen to music, I don’t want to ram politics down their throats. It ruins the magic of the music. I just think it’s taking unfair advantage of the audience to sort of slip in some specific political message while they’re captivated by your music. Politics should not be run like a circus.”

Still, Ronstadt appeared to be a person who stayed informed on the issues of her day, noting in late December 1976 that she was a daily reader of the Wall Street Journal. She would not likely be retired from politics for very long.

Ronstadt Rising

Ronstadt’s musical career, meanwhile, was heading into the stratosphere. In August 1976 she released Hasten Down the Wind, an album that included her version of Buddy Holly’s “That’ll Be The Day,” the single for which hit No. 11 on both the Billboard and Cash Box charts. It also rose to No. 27 on the Billboard country chart. Hasten Down the Wind also included a cover of Willie Nelson’s classic “Crazy,” which became a Top Ten country hit for Ronstadt in early 1977.

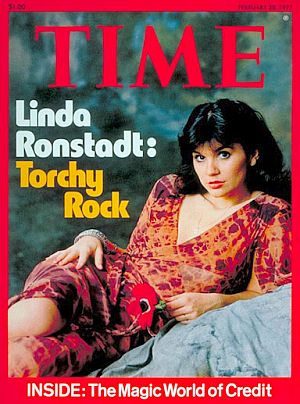

Hasten Down the Wind was Ronstadt’s third straight million-selling album – a feat no other female artist had then accomplished. The album earned her a Grammy Award for Best Pop Vocal Performance, Female. It was her second Grammy. In early December 1976 she appeared on the cover of Rolling Stone for the second time, as photographed by Annie Leibovitz. That Christmas season, Ronstadt issued a Greatest Hits LP that also became a top seller. And while Jerry Brown was not the Democratic Presidential nominee that political season, Ronstadt was invited to sing at Jimmy Carter’s presidential inaugural in January 1977. Meanwhile, the notices on her music kept coming. By late February 1977, she appeared on the cover of Time magazine (see below right) with the cover-story tagline: “Linda Ronstadt: Torchy Rock,” referring to her love-hurts balladeering in the rock ‘n roll age. Said Time: “Ronstadt has used the driving energy of rock and the melancholy of country music to transport …her audiences into a region…rarely explored by a mainstream singer in the past two decades. …[S]he has the neural-overload generation…screaming for a kind of music that … goes back to the cabaret singing of Ella Fitzgerald, Billie Holiday and Peggy Lee. Linda has made the Stones’ people listen to a torch singer. Try a new name: torch rock.” Time also added that Ronstadt was “a superstar on the verge of becoming …a Big Superstar.”

|

“Torchy Linda”

February 28th, 1977: Time magazine cover, “Linda Ronstadt: Torchy Rock.” Photo, Milton Greene. Click for copy.  Linda Ronstadt as photographed by Annie Leibovitz, 1976. Still, at least part of Ronstadt’s image in her heyday was that based on her sex appeal, exploited by more than Rolling Stone and Time, also seen in her mid-1970s album covers as well as her nightclub and rock concert attire, which could run to hot-pants-and-heels for some performances. But Ronstadt was also a women’s rights advocate, especially in her profession. Peter Asher, for one, called her “an extremely determined woman, in every area. To me, she was everything that feminism’s about.” In the October, 14th, 1977 issue of New Times magazine, John Rockwell wrote a piece titled “Linda Ronstadt: Her Soft-Core Charms,” a piece that covered Ronstadt’s career and persona at the time, quoting her during an ongoing interview. In the piece, Rockwell noted: “Even before her 1970 Daisy Mae, Moonbeam McSwine album cover on Silk Purse [her second album] Linda was regarded as a sex symbol. Then it was braless bouncing and bare feet; today, it’s more sophisticated and complex, though no less overt…” Then Rockwell added there were “problems in being a sex goddess,” and that Linda was mindful of those, quoting her as follows:

“…I don’t know how good a sex symbol I am, but I do think I’m good at being sexy. The sexual aspect of my personality has been played up a lot, and I can’t say it hasn’t been part of my success. But it’s unfair in a way, because I don’t think I look as good as my image. Sometimes I feel guilty about it, sometimes I feel embarrassed about it, sometimes I feel I have to compete with it. But that’s part of the fun, too- that’s part of the charade. When you look at somebody like Jean Harlow real close, she really did have an exquisitely formed face and beautiful hair and beautiful skin and a real gorgeous figure, and those are things I just don’t have. But I don’t think they’re essential to being attractive. Sometimes they’re more of a handicap than a help. I think vitality is what is attractive to people. That’s why there are a lot of pretty girls that are kind of boring to look at. If I get a hot romance, my sexuality is likely to work whether I curl my hair and put makeup on or not. When it’s successful and I’m at my shining best, I like to think of it as sassiness that incorporates sexuality and strength. It’s aggressive without being intimidating. As long as there’s strength in my attitude, I like it.” Still, some years later, in a September 2008 New York Times piece by Patricia Leigh Brown, Ronstadt explained of her rock ‘n roll years that she was marketed as “this sexualized being, somebody else’s version of me walking around with my name. It became a strange distortion. Eventually I had to put out the complete version of who I was.” Which she eventually did, both in her later personal life and through her demonstrated musical diversity. As John Rockwell would note in his 2014 Rock Hall of Fame biographical essay on Ronstadt, in which he would make special mention of Ronstadt’s vocal range and versatility: “People may have loved her looks, but they bought her records because of the sounds she made.” |

Cover for Linda’s Ronstadt’s “Blue Bayou” single from her 1977 album, ‘Simple Dreams’. Click for single.

Music Player

“Blue Bayou”- Linda Ronstadt

On the Billboard country chart, Simple Dreams knocked Elvis Presley out of the No.1 slot. The album would sell over 3.5 million copies in less than a year in the U.S. alone, and would also hit No. 1 on Australia and Canada’s pop and country charts.

Simple Dreams also spawned a string of hit singles including covers of Roy Orbison’s “Blue Bayou”; Buddy Holly’s “It’s So Easy,” and up-and-coming songwriter Warren Zevon’s “Poor Poor Pitiful Me.” Of the three, “Blue Bayou” – which included Don Henley of the Eagles singing backup – was the biggest hit, rising to No. 3 on the Billboard pop chart in late 1977, where it held for four weeks. It also hit No. 2 on the Cash Box chart, No. 2 on the country chart and No.3 on the “easy listening” chart. “Blue Bayou” would become one of Ronstadt’s signature tunes. It sold more than 1 million copies by January 1978, and would later surpass the 2 million mark, becoming a worldwide hit with a Spanish version as well.

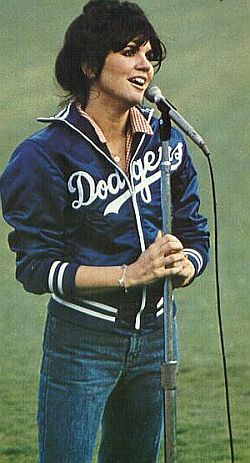

Oct 24, 1977: Linda Ronstadt, National Anthem at World Series.

Jerry & Linda

As for Jerry Brown and Linda Ronstadt, they continued to see each other in the late 1970s. In December 1977, it was reported that Brown took Ronstadt to some of his old haunts in San Francisco where he had grown up: City Lights Bookstore, a landmark of the 50s beat culture, the Spaghetti Factory, and the museums at the Academy of Sciences in Golden Gate Park. Later that month, they spent the Christmas holiday together in Malibu. In the following year, they were seen together occasionally at public events, ranging from a March 1978 tribute to Neil Simon at the Long Beach Civic Auditorium to a reception at the Beverly Wilshire Hotel for a group of Chinese diplomats. They also appeared together at rock music hangouts such as the Roxy in Los Angeles.

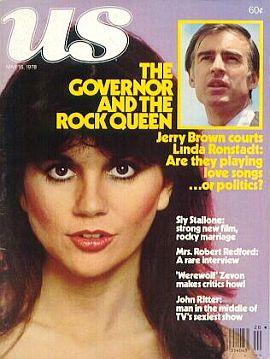

On May 17, 1978, US magazine put Ronstadt on its cover along with a smaller inset photo of Governor Jerry Brown, with the headline: “The Governor and The Rock Queen” plus an additional teaser tagline that read: “Jerry Brown courts Linda Ronstadt: Are they playing love songs…or politics?”

May 17th, 1978: ‘US’ magazine features “The Governor & The Rock Queen” on its cover. Click for copy.

Still, some believed Brown’s relationship with Ronstadt was just a friendship and nothing more. “I just think he uses Linda’s home as a sanctuary,” said Robert Pack in a May 1978 article in US magazine. “It’s situated among an expensive group of houses that are guarded and closed off to the public,” explained Pack, whose biography, Jerry Brown: The Philosopher Prince, was published that year by Stein & Day. “His favorite pastime is walking on the beach. And he takes his privacy seriously…I don’t think he would have a serious relationship with her because of her background,” Pack noted, referring to numerous affairs Ronstadt acknowledged having. Ronstadt, for her part, found reports of her many involvements to be greatly exaggerated, once quoted as saying: “I wish I had as much in bed as I get in the newspapers.”

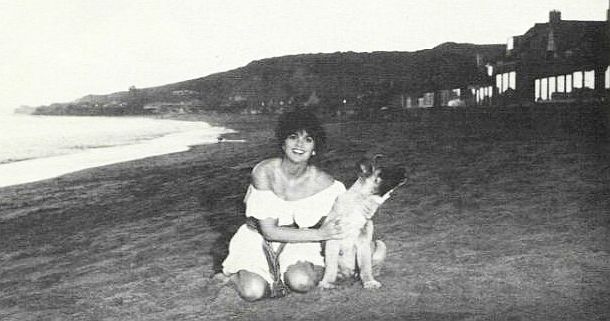

May 1978: Linda Ronstadt with canine friend on the Malibu, California beach near her home, reportedly a location frequented by Jerry Brown who was fond of long walks along the beach.

Jerry Brown as governor, meanwhile, was very popular among California voters. In his first year as governor, Brown had a voter approval rating of 87 percent – then the highest in the history of polling in the state. Brown’s popularity, and public opinion about him, was then being watched very closely by President Jimmy Carter’s staff in Washington, then monitoring Brown’s activities. Carter’s aides considered Brown to be the “single largest threat” to the President’s re-election in 1980. Yet first, before Brown could challenge Carter, he faced a gubernatorial re-election campaign in California, beginning with the 1978 primary elections.

Seeking Re-Election

July 19, 1978: California Gov. Jerry Brown makes a point at news conference in Los Angeles during his reelection bid as tax reformer Howard Jarvis and reporters look on. AP photo.

The one big issue in California during the time of primaries was Proposition 13, a ballot initiative authored by anti-tax crusader Howard Jarvis. Prop 13 sought to drastically reduce property taxes and change the way property taxes were calculated – a provision if enacted would play havoc with government budgets and funding of key services. Younger and most Republicans supported Proposition 13 while Brown and most Democrats opposed it. The initiative, which appeared on the June 6 primary ballot, passed with 64.8 percent of the vote and is still in effect today.

Then came the general election campaign in the fall of 1978. With the apparent taxpayer revolt now enrolled in law, Republican candidate Younger attempted to seize the Prop 13 momentum and Brown’s opposition to it. Younger, however, was not the best campaigner, and his organization faltered. The Republican primary battle had also drained Younger’s campaign of money, leaving him short of funds in the general election. Brown, on the other hand, saw a campaign opening.

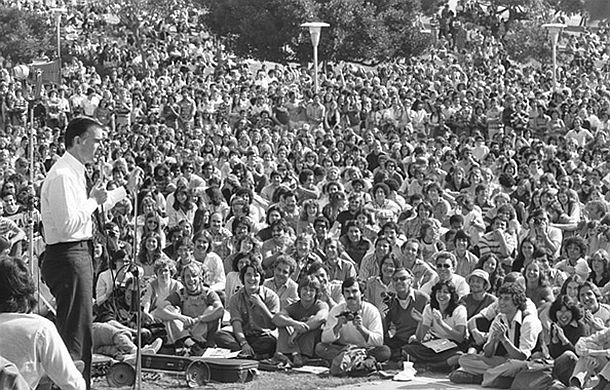

Fall 1978: California Governor Jerry Brown brings his re-election campaign to UCLA's Westwood campus where he addressed more than 5,000 students. Photo, L.A. Times.

During the primaries that summer, Brown had called Prop 13 “consumer fraud, expensive, unworkable and crazy, the biggest can of worms the state has ever seen.” But in the June election ballot vote, more than 4 million voters went for Prop 13 by a 2-1 margin. Once these results were in, Brown cleverly pivoted to a new position as the would-be top official in charge of implementing the law, promising, as enforcer-in-chief, if elected, to back the law.

Nov 1978: Jerry Brown with his parents, celebrating his re-election victory to a 2nd term as California’s governor.

During his campaign in 1978 Brown opposed another high-profile initiative– this one on the general election ballot. Proposition 6, also known as the Briggs Initiative, sought to ban gays and lesbians from serving as public school teachers in California. Brown opposed and helped defeat the initiative on November 7.

Jerry Brown ultimately won reelection in a landslide, beating Republican Evelle Younger by some 1.3 million votes, one of the biggest margins in California election history.

Linda’s 1978

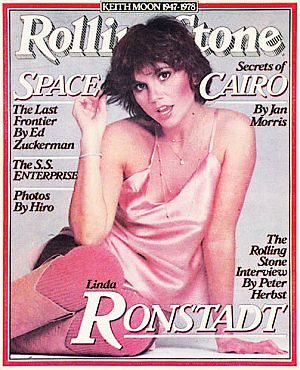

Oct 1978: Linda Ronstadt on Rolling Stone cover in a photo by Francesco Scavullo for interview story. Click for copy.

Ronstadt appeared on another Rolling Stone cover October 19th in a photo by Francesco Scavullo, and was also featured in the magazine’s interview. She also appeared in the 1978 film FM, about competing radio disc jockeys and the rock music business. In the film, Ronstadt performed the songs “Poor, Poor Pitiful Me,” “Love Me Tender,” and the Rolling Stones’ “Tumbling Dice.”

Earlier that year, in July, she made a guest appearance in her hometown of Tucson appearing with the Rolling Stones at the Tucson Community Center where she and Mick Jagger sang “Tumbling Dice” together.

Linda Ronstadt performing in 1978.

By the end of 1978, Linda Ronstadt had solidified her role as one of rock and pop’s most successful solo female acts. She was selling out her rock concerts, including those in large arenas and stadiums, with tens of thousands of fans.

According to some sources, she was the “highest paid woman in rock,” with income that year estimated at more than $12 million, or more than $43 million in today’s dollars. Her 1978 album sales were reported to have reached some 17 million units – with a gross return of well over $170 million in today’s dollars.

Billboard magazine crowned Ronstadt with three No. 1 Awards for the Year – Pop Female Singles Artist, Pop Female Album Artist, and overall Female Artist of the Year. By then six of her albums had exceeded 1 million in sales, three of which had been No. 1 on Billboard, as well as numerous Top 40 singles.

Her friend Jerry Brown also had a pretty good year. Following his reelection as California’s Governor, he was expected to mount a second try for the Democratic Presidential nomination in 1979-1980. But before he did, he and Linda Ronstadt would have what some might call a high-profile moment.

Jerry Brown and Linda Ronstadt in London airport during their April 1979 Africa trip.

Trip To Africa

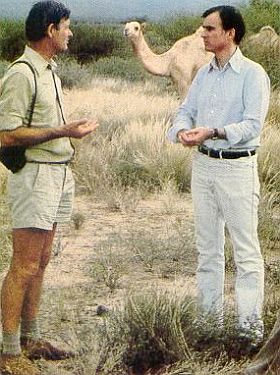

In early April 1979, Governor Jerry Brown and rock star Linda Ronstadt decided to do some traveling together. The governor had been advised to go to Africa and meet with some of its national leaders. There were also environmental issues he wanted to explore there.

The couple perhaps thought they could mix a little business with pleasure, take a respite from their busy lives, and explore Africa’s land, wildlife and culture. The period they selected to travel also included Jerry Brown’s 41st birthday.

On April 6, 1979, the couple left for their trip as the Los Angeles Times reported in a news story headline: “Brown, Miss Ronstadt Slip Quietly Out of New York; Board Plane for Africa.” But if they thought their trip would go unnoticed in the U.S, or that there would be little interest in them in Africa, they were sadly mistaken.

At the time, there had been a sizable contingent of western photographers and reporters already in Africa, trying to cover a war in Uganda. But failing to gain entry to that country, they turned their cameras and attention to covering the California Governor and his rock star guest. Reporters and photographers camped outside hotel rooms and mobbed the couple whenever they appeared.

In Africa, Jerry Brown spent time visiting African officials and listening to environmental experts. |

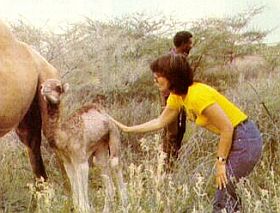

Linda Ronstadt, with baby camel in Africa, also spent time alone as Brown attended meetings. |

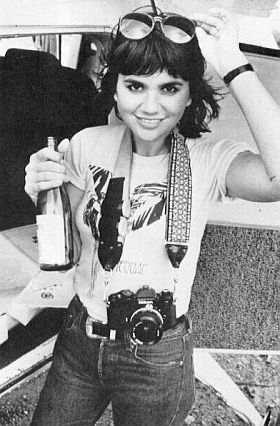

Linda Ronstadt was not happy with the stalking press in Africa, but did make a truce with them. Look. |

The press stalked the couple at Nairobi’s airport, where Ronstadt was reluctant to show herself to board a plane, even though Brown coaxed her to let the press have one photo and be done with it. One report quoted a Ronstadt friend as saying the press really freaked her out and that she felt badly that she was “ruining Jerry’s trip.”

When Brown set off for meetings with African presidents or environmental officials, Ronstadt often remained behind in the hotel or cottages where they has stayed. At one point, it was reported that she inquired about an early departure. One April 11th, 1979 Los Angeles Times headline noted:“Brown Politicks; Miss Ronstadt ‘May Go Home’.”

However, the couple did have some luxury camping in Tanzania, where they also safaried to watch buffalo, wildebeests and cheetahs, later dining on beef Wellington around a campfire. And Ronstadt established a truce with the press, sharing stories and drinks with them at one point. Near the end of their trip, Ronstadt departed separately and flew to London, where Brown later caught up with her, flying home together to Los Angeles.

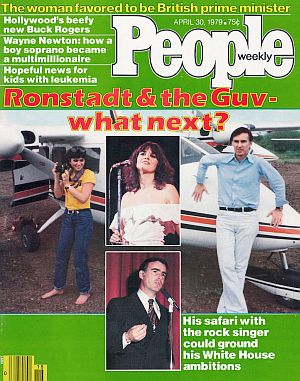

Meanwhile, the press coverage of their trip back in the States had been reported by the Los Angeles Times and other newspapers, and soon the magazines had stories as well, including cover stories in Newsweek’s April 23 edition (shown at the top of this story), and People’s April 30th edition. Look magazine ran a later story on the trip in June. The magazine accounts played up the relationship side of the story, and also what the trip might mean for Brown’s presidential ambitions.

Many in the political community then following the reporting on the Brown/Ronstadt trip, believed Brown had made a political misstep by taking the trip with Ronstadt. Some felt he had damaged his chances of being a prominent challenger to incumbent Jimmy Carter for the 1980 nomination. One senior Carter aide told Time magazine he thought the trip would “hurt [Brown] in a serious way,” adding, “I can’t help but wonder if there isn’t something self-destructive in him.” Democrats watching from the early primary state of New Hampshire had similar thoughts. Dudley Dudley, a leading liberal Democrat there told Time: “In political terms, this sort of thing is counterproductive. A lot of people are chuckling about [his trip with Ronstadt].”

The Newsweek and other stories on the Africa trip also refocused attention on the Brown/Ronstadt relationship and what had or had not transpired between the two in Africa, as well as previously back home. Newsweek’s writers asked, “were the singer with a heart like a wheel and the governor with a soul set on the White House getting it all together at last?” One rumor at the time had it that Brown and Ronstadt were going to the slopes of Mount Kilimanjaro to be married.

In terms of what had already transpired between the two back home, Newsweek reported that they took long walks together, “hand in hand,” along the Malibu beach; sometimes went to midnight Japanese movies in West L.A., or enjoyed country music “at the funky Palomino out in the San Fernando Valley.” And as regulars at the El Adobe restaurant where they met, co-owner Frank Casada reported them having a good time there, enjoying each other’s company, and giving each other pecks on the cheek occasionally.

“They really like each other,” explained California State Assemblyman Willie Brown in the Newsweek story – a friend who had spent time with them. “He’s a different person when he’s with her,” Willie Brown said. “There’s a side the public never sees. He’s flirty, flippant and very funny. And he’s as interested in her physically as I’d like to be.”“It’s a very, very special relationship that they have,” one of Brown’s aides was quoted in the Newsweek story. “It’s a very important thing, and it’s not something that either of them takes lightly.”

But whether the couple had more serious intentions ahead, was quite another matter. Both had made statements they could not be married to one another, Brown saying it would stop him from reaching the White House, and Ronstadt saying that the political life for her would be too confining.

Yet some of Ronstadt’s friends offered Newsweek a different take: “Marrying Jerry is an urge that comes on her periodically. She wants a sense of stability. She has talked about their becoming hermits on Jerry’s land in northern California.” But Linda’s mother Ruthmary Ronstadt, weighed in with a definitive “I know she would not like being a political wife.” And Ronstadt herself – pointing to an occasion when Mick Jagger breezed through town and called her to meet him in Mexico – acknowledged, “that’s the sort of thing I couldn’t do if I was married to Jerry.” Still, they continued their relationship in the meantime.

In November 1979, Jerry Brown formally announced that he would be a candidate for the Democratic Presidential nomination in 1980.

1979-1980

“Brown-for- Prez” (Pt 2)

Campaign placard for Jerry Brown in 1980 displays slogan: “A President Who Owes No Favors, Favors The Nation.”

Jerry Brown had been a proponent of energy alternatives to both continued oil import dependency and nuclear power, and so, was a politician who might draw some attention nationally by way of these issues. But Brown was also now a second term governor, and had a record of what he had and had not accomplished.

In his first term as California governor, Brown came down hard on crime, refused to raise taxes, and sought to eliminate waste in the state bureaucracy. Personally, he had refused the trappings of office early on, living frugally without the big limo and Governor’s mansion. But liberals believed he had fallen short on job programs for the inner cities, child-care, housing for the poor, and tax reform. Brown did develop a strong relationship with the large Mexican-American community, an important voting bloc. He also negotiated a landmark farm-labor law with Cesar Chavez, the growers, and the Teamsters Union. And he signed laws decriminalizing marijuana, another ending oil depletion allowances, and a third permitting sexual freedom between consenting adults.

1979: California Governor Jerry Brown speaking at a mass transit conference during his second term.

In California, some viewed Brown as an opportunist, hellbent on the White House. State House Republican minority leader Paul Priolo stated at one point that Brown’s philosophy was “to do what’s necessary to become President.” Some even suggested that his relationship with Ronstadt was a calculated media ploy to further his career.

In November 1979 when he announced that he would be a candidate for the 1980, Democratic Presidential nomination, Brown offered a platform with three main planks: a call for a constitutional convention to ratify the Balanced Budget Amendment, a promise to increase funds for the space program, and, in the wake of the 1979 Three Mile Island nuclear powerplant accident, opposition to nuclear power. The anti-nuclear movement in California was especially strong, and Brown had addressed activist gatherings that helped give him national visibility on the issue.

June 30th, 1979: California Governor Jerry Brown addressing a crowd of about 25,000 at an anti-nuclear rally in San Luis Obispo, California. Los Angeles Times.

On the subject of the 1979 energy crisis, Brown charged that Carter had made a “Faustian bargain” with the oil industry. He also declared that he would greatly increase federal funding of research into solar power. During his campaign he described the health care industry as a “high priesthood” engaged in a “medical arms race” and called for a market-oriented system of universal health care. Brown also endorsed the idea of mandatory, non-military national service for the nation’s youth, and suggested that the Defense Department cut back on support troops while beefing-up the number of combat troops.

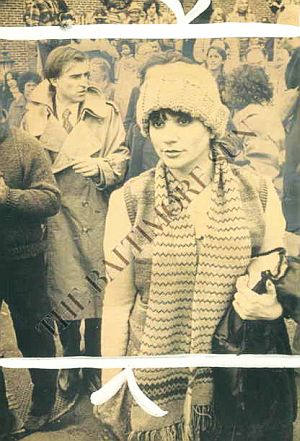

Feb 25, 1980: Linda Ronstadt campaigning in Portsmouth, New Hampshire with Jerry Brown – seen at left in trench coat behind Ronstadt. Photo with edit marks, Baltimore Sun.

But the more serious problem for Brown as a challenger to Carter came from the rival candidacy of liberal icon, Edward M. Kennedy of Massachusetts. Senator Kennedy had refused to run previously in 1972 and 1976, primarily due to his Chappaquiddick auto accident and the death of passenger Mary Jo Kopechne. But 1980, many believed, was Kennedy’s moment, and he mounted a major challenge to Carter.

Still, Brown continued his candidacy, and among his supporters were a number of film stars and others from Hollywood, as well as those from the music industry. Linda Ronstadt did benefit concerts for Brown, including one on December 22nd, 1979 in Las Vegas. At that concert, she mentioned on stage that evening that Brown had been running hard for president “in the the last two months” and that she hadn’t seen him much during that time, “except on TV.” She went on to say that he was coming home soon, and dedicated the next song in her performance to him – “My Boyfriend’s Back.” Another benefit concert for Brown on December 24th that year included others from Hollywood and the music business, including Jane Fonda, Helen Reddy, and members of the rock band Chicago. The star-studded benefit concerts, however, did not produce the turnout or revenue the Brown campaign had hoped for.

Campaign button touting “Jerry & Linda in 1980."

Jerry Brown’s supporters from Hollywood and the music industry, however, could cut both ways with voters. Conservative commentators of the day began describing some of Brown’s supporters such as activists Jane Fonda, Tom Hayden, and Jesse Jackson as on “the fringe,” which did hurt Brown in certain quarters.

Brown appeared on the ballot in a number of primary states. In the February 26, 1980 New Hampshire primary, however, he received only 10 percent of the vote. By late March 1980, Brown had spent $2 million but had won no primaries. Kennedy, on the other hand had beaten Carter in the Connecticut and New York primaries on March 25th, and seemed to be picking up steam.

1980: Governor Jerry Brown being interviewed in Los Angeles, CA.

Then came a plan to film Brown on the steps of the Wisconsin state capitol at Madison in a special 30-minute event to be broadcast live and then used as a campaign commercial. Hollywood’s Francis Ford Coppola was retained to produce and direct the event, and a thoughtful speech was prepared titled, “The Shape of Things to Come.” However, due to technical problems, the event did not go well, and contributed to the melt-down of Jerry Brown’s candidacy.

On April 1st, 1980, after finishing 3rd in the Wisconsin primary behind Carter and Kennedy, Brown withdrew from the Democratic Presidential race. Momentum thereafter went briefly in Kennedy’s direction after Carter’s attempt to rescue the hostages on April 25th ended in disaster. Still, Carter was able to hold off Kennedy, winning the nomination in the end, but losing to Ronald Reagan in the 1980 general election.

Linda’s Interview

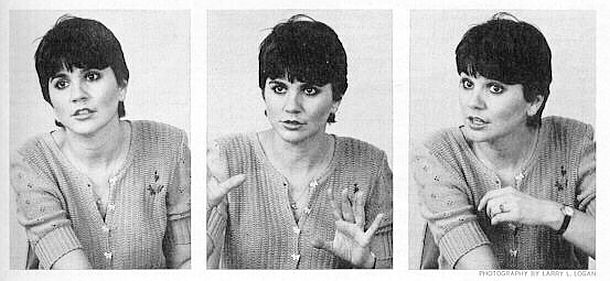

A few days after Jerry Brown quit his presidential bid, Linda Ronstadt appeared on the April 3rd, 1980 cover of Rolling Stone in a piece titled “The Styles of Linda Ronstadt,” with Annie Leibovitz photos. However, around the same time, she had also given an interesting interview to Playboy magazine – an interview conducted earlier that spring that was published in the April 1980 issue.

The interview was billed by Playboy as: “a candid conversation with the first lady of rock about her music, her colorful past, her new image, and her ‘boyfriend,’ Jerry Brown.” The magazine likely reached subscribers and the newsstands before Jerry Brown had quit the presidential race, and so would still be topical with Brown’s candidacy in mind. But in the interview, Ronstadt offered some thoughtful observations on how she dealt with her celebrity and political involvement. A few excerpts follow below:

…PLAYBOY: Why weren’t you involved in the benefits opposed to nuclear power?

RONSTADT: I didn’t have a band and I felt it might be construed as an attempt on my part to start stumping for Jerry Brown.

PLAYBOY: What’s wrong with that?

RONSTADT: I feel it can be dangerous for me as an artist to get involved with issues and, particularly, with candidates. But at some point, I feel like I can’t not take a stand. I think of pre-Hitler Germany, when it was fashionable for the Berliners not to get involved with politics and, meantime, this horrible man took power.If I am saying things about nuclear power, I want people to go out and learn about it. I don’t want them to say “No nukes” because Jackson and Linda say it. But it is difficult for me as a public person. I don’t want people to take my word for something because they like my music. That’s a danger in itself. I am real aware of my ability to influence impressionable people and I am reluctant to wield that power. If I am saying things about nuclear power, I want people to go out and learn about it. I don’t want them to say “No nukes” because Jackson (Browne) and Linda say it. I don’t want them to think that to be hip, they have to be a no-nukes person. I don’t want people to think about issues when they hear my music. I really want them to hook their dreams onto what I am singing. When I’m out in public, I want to be singing.

PLAYBOY: But you are stumping for Brown. You had a $1000-a-couple dinner for him and you’re doing concerts, something you said you’d never do.

Photos of Linda Ronstadt as she was being interviewed by ‘Playboy’ magazine for the April 1980 edition. Interview by Jean Vallely, photos by Larry Logan.

RONSTADT: You know how most people burn their bridges behind them? Well, I have a tendency to burn my bridges ahead of me. I swore up and down I wouldn’t do a benefit for Jerry. The artistic reason is the selfish reason, but also, I always thought that if I did a concert for Jerry, it would be perceived by the public as him trying to use me. They would say, “I told you all along: The basis of their relationship is that she can do concerts for him and make him a lot of money.” But there is no way for me to stay neutral.…A candidate like Ronald Reagan can go to Westing- house and ask for lots of money…Jerry Brown can’t go to Westinghouse. He can only go to indivi- duals. He has no corporate financing for his ideology. …Jerry Brown can’t go to ARCO for money for solar power, because it’s not in the company’s interest…. If I won’t support him, and I know him best, it looks like an attack. I would like him to be able to speak his ideas. I think they are really important and good and, for the most part, he’s right. It’s so hard for me, not only as a public figure but also as someone who believes in him, cares about him, is close to him and is on his side. I want to be on his side.

PLAYBOY: What’s the reaction to your limited public support of Brown?

RONSTADT: I’m going to take a lot of heat for it, but I’m ready. I just don’t feel that any of the alternatives are as good as Jerry, and that’s what it comes down to. Look at it this way: The Eagles and I, in a way, represent the antinuclear concern. Westinghouse is heavily invested in nuclear power. A candidate like Ronald Reagan can go to Westinghouse and ask for lots of money and despite the $1000 limit, Westinghouse can commandeer huge sums of money. Plus, it can hire lawyers and take out huge ads in the newspapers and continue to brainwash the American public about the safety of nuclear power, which I think is a lie. Jerry Brown can’t go to Westinghouse. He can only go to the individuals. He has no corporate financing for his ideology. A candidate like Jerry Brown can’t go to Arco for money for solar power, because it’s not in the company’s interest. I believe it’s in the public interest to have a candidate who is interested in furthering technology like solar power and protecting us from things like nuclear power.

PLAYBOY: Then you’re not wary about ill-informed performers’ affecting politics.

RONSTADT: A lot of us were naive in the beginning about doing benefits. We tended just to take people’s word for things. I don’t now. I read newspapers, periodicals. I’m not saying I’m an expert, but I am a hell of a lot better informed than before and better informed than the average person. I think my opinion is informed enough to put out there.…But if Frank Sinatra is going to do a benefit for Reagan, then I guess I have to do a benefit for Jerry…. Richard Reeves wrote sarcastically about how nobody would pay $400,000 an hour to watch him type, but Richard Reeves, in fact, swings much more influence with a typewriter than I ever could. He’s a political writer. He sways public opinion every day. Doing a concert for a candidate can’t swing an election. We flatter ourselves to think that. What I can do is provide better access to the public forum, and then it’s up to the public to decide. Artists like Jane Fonda, Joan Baez, Vanessa Redgrave, I say more power to them, they are sticking out their necks. I don’t particularly want to stick out my neck. But I don’t see how I can not take a stand. It’s dangerous territory for me, that’s for sure. But if Frank Sinatra is going to do a benefit for Reagan, then I guess I have to do a benefit for Jerry….

March 20, 1983: Linda Ronstadt and Jerry Brown attending the opening of ‘Dreamgirls’ at the Shubert Theater in Century City, California.

In the early 1980s, Jerry Brown and Linda Ronstadt would continue to be seen together occasionally. She joined him and other friends at an informal gathering in Sacramento on January 3, 1983 after he stepped down as governor. Later that year, on March 20th, 1983, they were photographed together attending the opening of the film Dreamgirls at the Shubert Theater in Century City, California. But after their active friendship years ended, Brown and Ronstadt went their separate ways, continuing in their respective careers.

In 1982, Jerry Brown could have sought a third term as governor, but instead decided to run for the U.S. Senate. He was defeated in that attempt by Republican Pete Wilson. Afterward, he took some personal time, traveling to Mexico to learn Spanish, to Japan to study Buddhism in a monastery, and to India to work with Mother Teresa. Upon his return in 1988, Brown won a race to become chairman of the California Democratic Party, and in that post he greatly expanded the party’s donor base. But in early 1991, Brown resigned as Democratic Party Chairman, announcing he would run for the U.S. Senate seat held by then retiring Alan Cranston. Although he led in the polls for both the nomination and the general election, he quit this Senate bid in favor of running for president for a third time in 1992. Running as an outsider, he won six primaries, but still lagged well behind frontrunner Bill Clinton.

1992: Jerry Brown, 2nd from left, was among the candidates competing for the 1992 Democratic Presidential Nomination, then including Sen. Tom Harkin (IA), far left, and R-L from Brown: Sen. Bob Kerry (NE), former Sen. Paul Tsongas (MA), and Arkansas Governor, Bill Clinton. AP photo, prior to a debate forum.

After Jerry Brown’s third failed attempt at the Presidency, many believed his political career was over, and for six years or so, he remained in the political wilderness. But in 1997, running as an independent, Brown became mayor of Oakland, California where he helped revitalize the city and reverse its hemorrhage of residents. In 2007, Brown ran for and won the post of State Attorney General, and four years later, succeeded Arnold Schwarzenegger in a third term as California’s governor. As this is written, Brown is running for an historic fourth term as California’s governor, which if he wins on November 4, 2014, will begin in January of 2015.

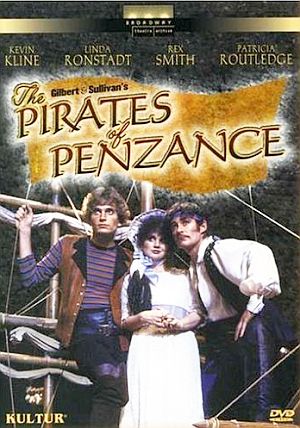

Linda Ronstadt, for her part, went on making music – all kinds of music. In 1981, she went to Broadway as Mabel in The Pirates of Penzance, co-starring with Kevin Kline. She also co-starred with Kline and Angela Lansbury in the 1983 film version. In music she continued to put out popular recordings and appear at concert venues. In 1983, her estimated worth was placed at over $40 million, mostly from records, concerts and merchandising But she soon tired of rock concerts, where the audience – sometimes into beer and pot – was not always focused on the performer. Ronstadt longed for venues that had “angels in the architecture,” as she once put it. In late 1984 she ventured into opera, cast as Mimi in La Bohème in New York City.Back in the studio, meanwhile, in 1983-1986, she collaborated with Nelson Riddle on songs from the Great American Songbook, producing three albums of jazz and traditional pop standards that between them sold more than seven million copies in the U.S. In 1987 she collaborated with Dolly Parton and Emmy Lou Harris to produce the album Trio which held the No.1 position on Billboard’s country albums chart for five weeks. In late 1987, Ronstadt released Canciones de Mi Padre, an album of traditional Mexican folk songs.

For Ronstadt the 1980s proved to be just as commercially successful as the 1970s. Between 1983 and 1990, she turned out six additional million-selling albums; two of which sold more than three million U.S. copies. In 1991, she released a second album of Mexican music, Mas Canciones, for which she won a Grammy. And there is lots more about her music, politics, and personal life – covered elsewhere in greater detail.

Linda Ronstadt as photographed by 'Time' magazine in 1977.

In April 2014, Linda Ronstadt was inducted into the Rock and Roll Hall of Fame. In July 2014, President Obama awarded her one of twelve 2013 National Medals of Arts and Humanities. He also stated that he had had a crush on her when he was younger. Engaged to filmmaker George Lucas for a time in 1984, Linda Ronstadt never did marry. In her 40s, during the 1990s, she adopted two children – Mary and Carlos, now young adults. Her autobiography, Simple Dreams: A Musical Memoir, was released in September 2013 when it debuted in the Top 10 on the New York Times best sellers list.

In that memoir she writes: “Jerry Brown and I had a lot of fun for a number of years. He was smart and funny, not interested in drinking or drugs, and lived his life carefully, with a great deal of discipline.” She said she found him to be “a relief” from the musicians she hung around with. But she also added: “Neither of us ever suffered under the delusion that we would like to share each other’s lives. I would have found his life too restrictive, and he would have found mine entirely chaotic…Eventually we went our separate ways and embraced things that resonated with us as different individuals…We have always remained on excellent terms.”

For additional stories at this website on music please see the “Annals of Music” category page, and for politics, the “Politics & Culture” page. See also, “Noteworthy Ladies,” a topics page with more than 40 story choices on the history and careers of famous women. Thanks for visiting – and if you like what you find here, please make a donation to help support the research, writing, and continued publication of this website. Thank you. – Jack Doyle

|

Please Support Thank You |

____________________________________

Date Posted: 22 August 2014

Last Update: 17 July 2023

Comments to: jackdoyle47@gmail.com

Article Citation:

Jack Doyle, “Linda & Jerry: 1971-1983,”

PopHistoryDig.com, August 22, 2014.

____________________________________

Books & music at Amazon.com…

Sources, Links & Additional Information

1970: Linda Ronstadt, long hair days. Photo, Michael Ochs. |

Jerry Brown featured on the cover of Time magazine’s October 21st, 1974 election year issue, “New Faces, Key Races.” |

Nov. 1974: Jerry Brown elected Governor of California. |

Linda Ronstadt performing, mid-1970s. Photo, Creem / Andy Kent. |

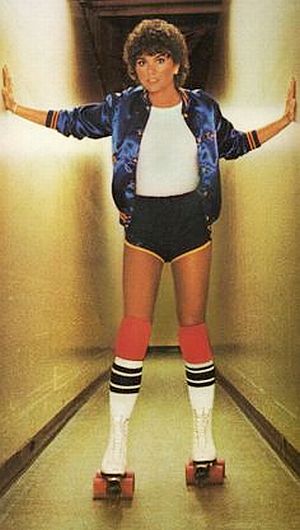

Linda Ronstadt on roller skates in photo from cover of her 1978 album, “Living in The USA.” |

Billboard on Hollywood’s Sunset Strip advertising a Linda Ronstadt concert at The Forum, December 1978. |

July 1978: Mick Jagger of the Rolling Stones and Linda Ronstadt performing “Tumbling Dice” in Tucson, AZ. |

“Linda Ronstadt,” in Holly George-Warren and Patricia Romanowski (eds), The Rolling Stone Encyclopedia of Rock & Roll, Rolling Stone Press, New York, 3rd Edition, 2001, pp. 837-839.

Kari Bethel, “Linda Ronstadt, Singer,” Contemporary Hispanic Biography/Encyc- lopedia.com, 2003.

“Linda Ronstadt,” Wikipedia.org.

Anne Johnson, “Ronstadt, Linda.” Contem- porary Musicians / Encyclopedia.com, 1990.

“Linda Ronstadt and Bobby Darin – Long Long Time” (her appearance on “The Darin Invasion 1970” TV special, October 1970), YouTube.com.

“Bright Song Style of Linda Ronstadt Lights Up Fillmore,” New York Times, May 9, 1971.

“Linda Ronstadt Gifted As Singer, But Her Country Style Art Reveals Contradictions,” New York Times, August 2, 1972.

“Can Linda Find a Focus?,” New York Times, November 11, 1973.

John Rockwell, “Linda Ronstadt Is Surer Now; Singer, Here for 3 Concerts, Shows New Confidence An Album Success Helps Her Revise Cult-Object Image,” New York Times, Sunday, January 26, 1975.

“Linda Ronstadt at Her Best,” New York Times, January 28, 1975.

“A Benefit for Jerry Brown,” Washington Post, May 6, 1976, p. 80.

Larry Rohter, “Pop and Politics: When Two Worlds Collide,” Washington Post, May 15, 1976, p. B-1

“You’re No Good,” Wikipedia.org.

“Jerry Brown Likes Granola, Zen and Winning Elections,” People, June 14, 1976, p. 43.

“Looking for Mr. Good Guy: The Democrats Wonder If Guru-Governor Jerry Brown Could Be the Answer,” People, June 14, 1976.

“Jerry Brown,” Wikipedia.org.

Cameron Crowe, “Linda Ronstadt: The Million-Dollar Woman,” Rolling Stone, December 2, 1976.

“Linda Ronstadt: a Vagabond Grows up as Country Rock’s First Lady,” People (double issue), December 27, 1976 – January 3, 1977.

Robert Hilburn, “Harris Averts the Ronstadt Connection,” Los Angeles Times, January 30, 1977, p. S-68

“Dramatic and Charming Ronstadt,” New York Times, August 24, 1977.

Robert Hilburn, “Ronstadt’s Concert Trail: Long Nights of Doubt,” Los Angeles Times, September 18, 1977, p. Q-1.

Mark Kernis, “’Simple Dreams’: A Masterful, Exciting New Album by Linda Ronstadt,” Washington Post, September 21, 1977, p. D-12.

Jack Ong, “Linda Ronstadt Sings Her Way to the Top,” Los Angeles Times, October 14, 1977, p. I-13.

Robert Windeler, “Liberating Linda; On the Charts and in Men’s Hearts, Rock’s Hottest Torch Linda Ronstadt Is No. 1,” People, Vol. 8, No. 17, October 24, 1977.

John Swenson, “Linda Ronstadt, Female Vocalist of the Year; At the Top of Her Field, She Become an American Heroine,” Circus, February 16, 1978.

Ed Ward, “The Queens of Rock – Linda Ronstadt, Joni Mitchell, Carly Simon and Stevie Nicks – Talk about Their Men, Music and Life on the Road,” US Magazine, February 21, 1978.

William Carlsen, “The Governor and The Rock Queen,” US Magazine, May 16, 1978.

“Elder Brown Has Wish–That Son Would Wed,” Los Angeles Times, September 14, 1978, p. B-3.

Nancy Skelton, “Called Man of Intrigue; Engagement Now Could Hurt Brown, Pollster Says,” Los Angeles Times, September 22, 1978, p. A-10.

“California Gubernatorial Election, 1978,” Wikipedia.org.

Vivian Claire ( for the Los Angeles Times), “Linda Ronstadt: Of Love And Drugs And Jerry Brown,” The Spokesman-Review (Spokane, WA), November 13, 1978 (second of a five-part series extracted from Vivian Claire’s biography, Linda Ronstadt ).

Tom Zito, “Sex and the Single Governor; Brown, Ronstadt: Good Fortune?,” Los Angeles Times, December 7, 1978, p. H-6.

Elizabeth Kaye, “Linda Ronstadt: Why Is She The Queen Of Lonely?,” Redbook, February 1979.

William K. Knoedelseder Jr. and Ellen Farley, “El Adobe Looks East; Jerry Brown’s Favorite Restaurant Aims for Washington,” Washington Post, April 5, 1979, p. D-1.

John J Goldman, “Brown, Miss Ronstadt Slip Quietly Out of New York; Board Plane for Africa, Los Angeles Times, April 7, 1979, p. A-1.

“Brown Politicks; Miss Ronstadt ‘May Go Home’,” Los Angeles Times, April 11, 1979, p. B-28.

Victoria Brittain, “The African Jaunt: On Safari With Jerry Brown And Rock Star Linda Ronstadt,” Washington Post, April 16, 1979, p. B-1.

“Politics Is a Real Jungle,” Los Angeles Times, April 20, 1979, p. D-6.

“Making the African Scene,” Time, April 23, 1979.

Tom Mathews, with Martin Kasindorf and Janet Huck, “Ballad of Jerry and Linda,” Newsweek, April 23, 1979.

Karen G. Jackovich, Harry Minetree, Patricia Newman, “Swinging Safari: Jerry Brown’s Safari with Rock Star Linda Ronstadt Could Just Be the End of Something Big,” People, April 30, 1979 Vol. 11, No. 17.

William K, Knoedelseder, Jr; Ellen Farley, “Where the Elite Meet Discreetly,” Los Angeles Times, Apr 22, 1979, p. U-3.

Jimmy Breslin, “She Stoops to Conquer–But What?,” Los Angeles Times, May 20, 1979, p. F-6.F6

“Ronstadt Takes on the Press,” Look, June 11, 1979.

Alan Baron, “Jerry Brown Rolls Out the Campaign Banner,” Los Angeles Times, November 4, 1979, p. E-1.

Kathy Sawyer, “Brown Launches Underdog Race,” Washington Post, November 9, 1979, p. A-1.

Laurie Becklund, Nancy Skelton, “Less Isn’t More at Brown Fund Raiser,” Los Angeles Times, December 22, 1979, p. A-30.

Laurie Becklund, “Ronstadt Shines a Little Light on Brown Campaign; Ronstadt Gives Boost to Brown Campaign,” Los Angeles Times, December 24, 1979, p. B-3.

Robert Hilburn, “Brown Benefit: Clash of Music and Politics,” Los Angeles Times, December 24, 1979, p. E-5.

Murray Fromson, “Undaunted by Iowa, Brown Sees Hope in Zero-Based Campaign,” Los Angeles Times, January 27, 1980, p. F-3.

William Endicott, “Ronstadt Joins Brown in Wooing Voters,” Los Angeles Times, February 25, 1980.

“Linda Tries ‘First Lady’ on for Size: ‘I’d Die Laughing’,” Los Angeles Times, March 4, 1980,

p. A-2.

Charlotte S. Perry, “Jerry Brown’s Dream-Turned-Nightmare; ’76 Celebrity Status Haunts Him in ’80 as Public’s Familiarity Breeds Contempt,” Los Angeles Times, March 28, 1980, p. C-7.

“Linda Ronstadt at Music Hall,” New York Times, April 17, 1980.

Robert Hilburn, “Linda Ronstadt: Opening Up on the Rock ‘n Roll Trail; On the Road with Ronstadt,” Los Angeles Times, April 20, 1980.

Jean Vallely, “Linda Ronstadt: a Candid Conversation with the First Lady of Rock about Her Music, Her Colorful Past, Her New Image and Her ‘Boyfriend,’ Jerry Brown,” Playboy, April 1980.

John J. Goldman, “Brown–From Celebrity to Good Soldier; Media Magnetism Is Gone,” Los Angeles Times, August 13, 1980, p. B-19.

“Linda Ronstadt Interview on Johnny Carson’s Tonight Show, 1983″ (part), You Tube.com, Uploaded on December 19, 2009.

Mary Ellin Bruns, “Ronstadt: The Gamble Pays Off Big” (interview), Family Weekly, January 8, 1984.

“What’s New with Linda Ronstadt? She’s Singing Her Love Songs to Star Wars Czar George Lucas,” People, March 26, 1984.

Patricia Leigh Brown, “Linda Ronstadt, Home Again,” New York Times, September 22, 2008.

“Linda Ronstadt Articles & Interviews,” Ronstadt-Linda.com (fan site).

“The Reinvention Of Calif.’s New and Former Governor,” NPR.org, November 18, 2010.

Nathan Masters, “Governor Brown, Then and Now,” KCET.org, January 13, 2011.

Jerry Roberts, “Shades of Jerry Brown: How and Why Governor Moonbeam Returned to Earth,” The Independent (Santa Barbara, CA), November 1, 2012.

Matthew Garrahan, “Second Coming: the Governor of California Talks about Taxes, Mother Teresa and Being Back in Charge,” FT.com (Financial Times), April 5, 2013.

Daniel Buckley, “Why Linda Ronstadt Still Matters to Tucson A Tucson Music Historian Reflects on the Lasting Influence of Our City’s Most Famous Musical Export,” Tucson Weekly.com, September 12, 2013.

John Rockwell, “Linda Ronstadt,” RockHall .com, Inducted 2014.

Anthony York, “Linda Ronstadt Recalls Time with Jerry Brown in New Memoir,” Los Angles Times, September 17, 2013.

Stephen Spaz Schnee, “Get Closer: An Exclusive Interview with Linda Ronstadt,” DiscussionsMagazine.com, Wednesday, May 14, 2014

Maureen Dowd, “Palmy Days for Jerry,” New York Times, March 22, 2014.

_________________________